Introduction

CMBS issuance is on track to finish 2019 on a

strong note as the fall in the 10-year Treasury rate

appears to have stimulated borrower demand. The

decline in the 10-year note reflects a slowing

global economy, with investors being drawn to

the relative safety and competitive yield of the

U.S. Treasury. With increased demand, the 10-

year Treasury rate declined in 2019 to levels not

seen since 2016. This likely contributed to the rise

in Q3 2019 conduit volume as commercial real

estate (CRE) borrowers sought to lock in longterm rates.

Introduction

CMBS issuance is on track to finish 2019 on a

strong note as the fall in the 10-year Treasury rate

appears to have stimulated borrower demand. The

decline in the 10-year note reflects a slowing

global economy, with investors being drawn to

the relative safety and competitive yield of the

U.S. Treasury. With increased demand, the 10-

year Treasury rate declined in 2019 to levels not

seen since 2016. This likely contributed to the rise

in Q3 2019 conduit volume as commercial real

estate (CRE) borrowers sought to lock in longterm rates.

Both long- and short-term interest rate movements

have been sizable in 2019. The 10-year Treasury,

which opened the year at 2.66%, dropped to a

year-to-date (YTD) low of 1.47% on August 28.

Over the last five years, (2015 to YTD 2019), the

10-year Treasury recorded its largest percentage

change in 2019 (slightly edging out 2016), from

its high (2.79%) to low point (see Figure 1). For

short term rates, the Federal Reserve has cut them

three times so far in 2019—for a total of 75 basis

points (bps), after effectuating four 25 bps rate

increases in 2018. Federal Open Market

Committee (FOMC) statements noted that the rate

reductions were taken to sustain the economic

expansion and as insurance against ongoing risks.

Tenant demand from job growth, as well as an

historically low unemployment rate and subdued

construction has extended the economic and CRE cycle. This backdrop has helped to support both property

fundamentals and valuations, which have generally eclipsed premarket peaks. And while we are late cycle,

oversupply and overleverage appear to be under control at a national level. Delinquency rates have also remained

relatively low, with CMBS 2.0 conduits posting a 30+ day delinquency rate of 0.89% as of October 31, 2019.

Factoring the current economic climate, low interest rates, and stable credit performance, we believe the stage is set

for CMBS issuance to surpass our forecasted 2019 volume and carry over into the new year. Even though issuance

lagged year-over-year (YoY) through Q3 2019, we believe that full-year (FY) 2019 is poised to exceed the 2018 total

of $75 billion. We also expect that rates will influence deal mix and as smaller to midsize borrowers take advantage

of lower rates, conduit issuance will exceed single borrower (SB) in 2020, after trailing in 1H 2019. Recent and pending

commercial real estate collateralized loan obligation (CRE CLO) deal announcements bode well heading into 2020

and we anticipate that CRE CLO issuance will rise again given investor appetite for yield in a low rate world.

In addition, with low interest rates and higher prices, defeasance activity should remain on solid footing as borrowers

look to refinance their loans. We believe that defeasances are favorable, from a credit perspective, as they substitute

high-quality government-backed securities for a loan’s CRE collateral. For more information on this topic, read our

As Freddie Mac K -Series Defeasance Accelerates, Supplemental Debt Slows report.

But this does not mean that CMBS and CRE issuance will move higher without some disruptions along the way.

Continuing trade talk, impeachment inquiries, global growth uncertainties, and domestic recessionary concerns are

expected to be unsettling headwinds. In the following section, we review the current lending environment as well

as underwriting standards in pre- and post-crisis CMBS followed by Kroll Bond Rating Agency’s (KBRA) forecast

for new issuance in 2020. We also examine the five major property types, highlighting the underlying demand and

supply factors for each sector, as well as our outlook for 2020. In addition, this outlook will discuss the CMBS

conduits that we rated so far in 2019. In the Surveillance section, we look more closely at what drove 2019 ratings

activity, as well as our expectations for rating actions in 2020.

2020 CMBS Outlook: This Time Is Different?

CRE and CMBS Underwriting in the Post-Crisis Era

While we expect issuance to rise, our 2020 CMBS and CRE CLO forecast also considered today’s competitive lending

environment. According to the Mortgage Bankers Association’s (MBA) 2Q 2019 Commercial/Multifamily Mortgage

Debt Outstanding report, compared to Q1 2019, commercial banks increased their CRE mortgage debt holdings by

1.7%, insurance companies by 1.4%, while CMBS, CDO, and other ABS issues lagged with a 1% increase. In addition,

CRE data provider CrediFi found that CRE loans make up a larger portion of banks’ balance sheets than is publicly

disclosed.1 Meanwhile, U.S CRE loan originations by foreign-owned institutions is at a faster pace compared to

domestic lenders, according to a Commercial Mortgage Alert analysis of data compiled by Trepp Bank Navigator.

KBRA expects a continuation of the strong lending competition in 2019 to extend into the coming year and influence

overall securitized volume as well as credit. But while CMBS loan originators maintained discipline for much of

2019, we have observed increases in the concentrations of loan-to value (LTV) and interest-only (IO) loans during

the fourth quarter. This begs the question of whether “this time is different.”

Unlike their predecessors, conduit CMBS 2.0 have generally stayed away from pro forma loans (something we have

yet to see in 2019 despite increased leverage and IO) and utilized in-place cash flows when analyzing and underwriting

CRE loan collateral. In addition, conduit CMBS 2.0 transactions have lower leverage points, but higher subordination

levels, compared to conduit 1.0, which can help to absorb loan losses.2 This lower leverage exists despite 10-year

Treasury rate levels, which are now about 225 bps lower (1.75%) than where they ended 2007, at about 4%. As

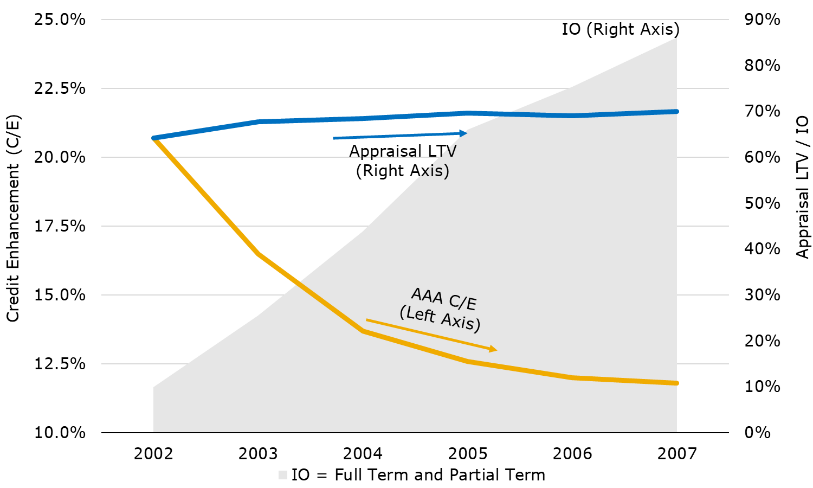

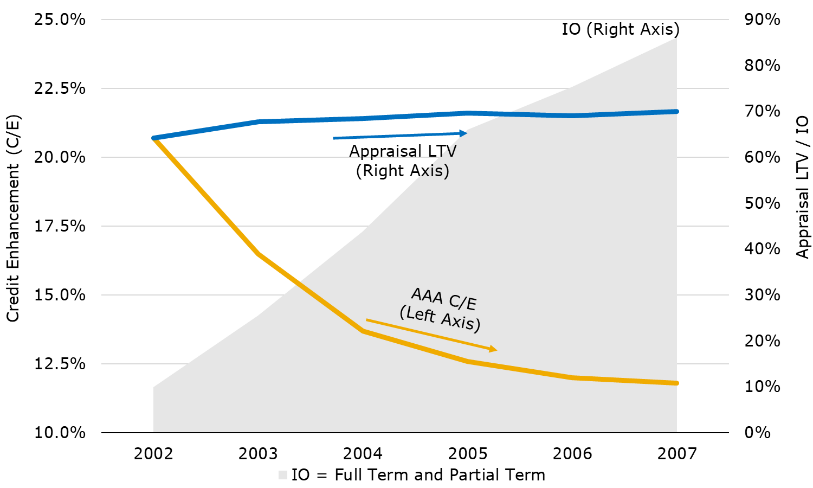

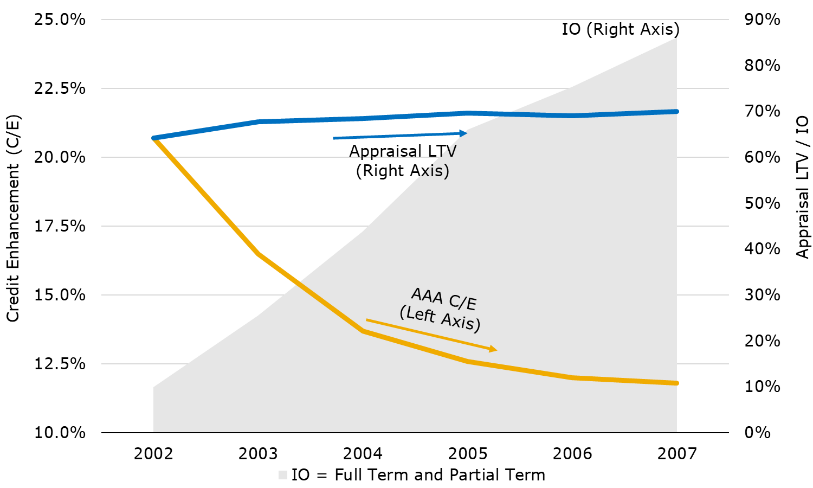

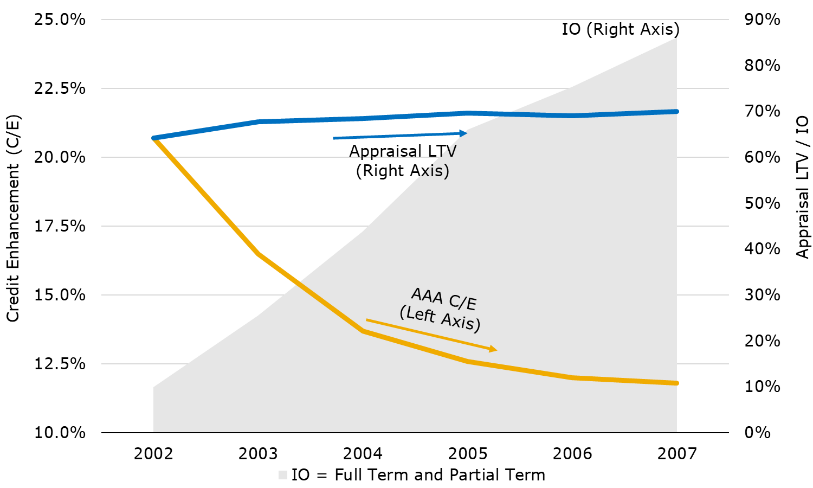

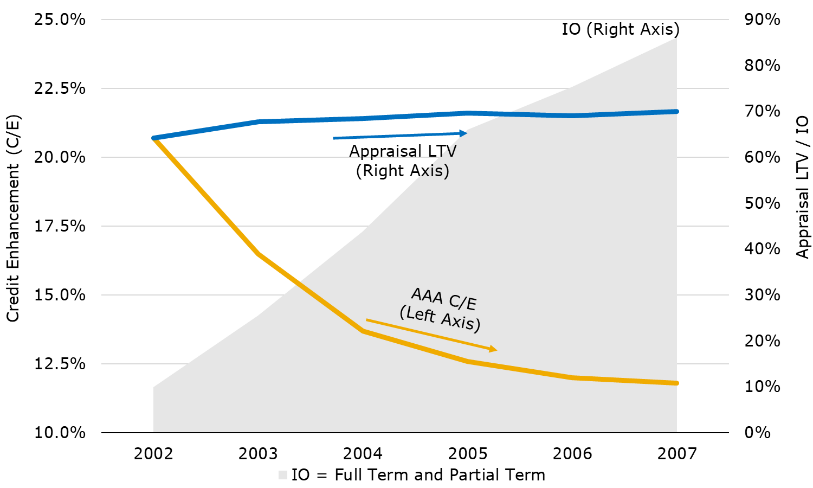

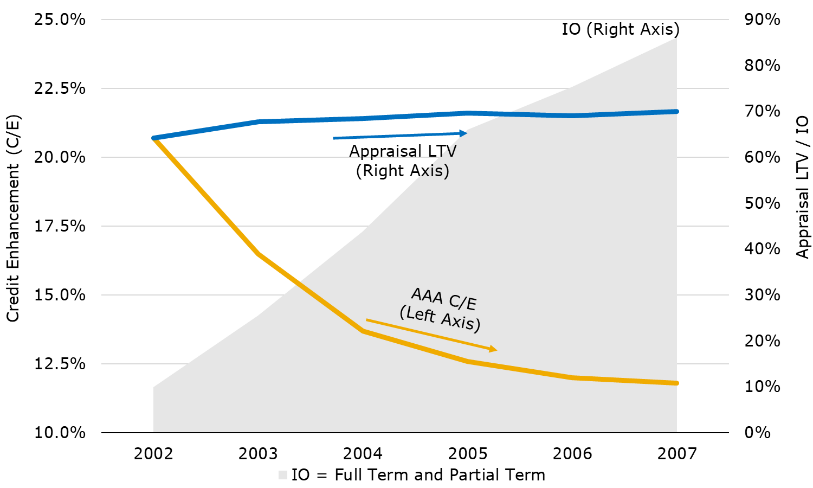

illustrated in Figure 2 and Figure 3, pre-crisis 2007 AAA and BBB- credit enhancement (C/E) levels stood at 11.8%

and 3.2%, respectively. This compares to post-crisis YTD C/E for AAA, which is almost double at 20.5%, and BBB-,

which is more than double at 6.9% (see Figure 4 and Figure 5). CMBS 2.0 leverage is also lower, with appraisal cutoff

LTVs of approximately 60% through early October 2019 compared to 70% in vintage year 2007.

To remain competitive, lenders have increasingly been using full-term and partial-term IO loans. These IO loan

types (in KBRA rated and non- rated deals) have experienced steady increases in 2.0, with YTD October levels at

58% and 23% (totaling 81%), respectively. KBRA’s IO index at the end of October was at a record high (65.7%)

since we started the benchmark in 2012. In our view, all else being equal, KBRA believes that IO loans are riskier

than amortizing loans, which provide for natural deleveraging over the loan term—and which leads to lower risk of

maturity default. Additionally, should an IO loan default later in its term, it will experience a higher loss given

default (LGD) relative to an amortizing loan, based on its higher outstanding principal balance.

Despite the increasing prevalence of IO, CMBS 2.0 issued to date appears to be better positioned than their 1.0

counterparts based on C/E, underwriting standards, and credit metrics. At this juncture, we believe that existing

issuance, generally, should be better able to weather a downturn in the economy compared to CMBS 1.0, although

performance will vary between deals.

Figure 1: Pre-Crisis: AAA Credit Enhancement, Leverage, and IO %

Figure 2: Pre-Crisis: AAA Credit Enhancement, Leverage, and IO %

Figure 3: Pre-Crisis: AAA Credit Enhancement, Leverage, and IO %

Figure 4: Pre-Crisis: AAA Credit Enhancement, Leverage, and IO %

New Issuance Forecast As discussed back in September in the Spotlight section of KBRA’s CMBS Trend Watch, while securitized issuance may not benefit from the amount of 10-year CMBS loans ($2.7 billion) scheduled to mature in 2020, we forecast an increase in 2020 volume, due to the rate environment and general attractiveness of CRE relative to other asset classes (see Figure 6). The 10-year Treasury, which opened at 2.66% in 2019, fell to a low of 1.47% in Q3, which has helped to generate increased interest in long-term conduit paper. In Q3 2019, conduit issuance increased around 80% to $32.5 billion from $18.2 billion in IH 2019, according to Commercial Mortgage Alert (CMA) data. Concurrently, there was a changing of the guard, with conduit issuance exceeding SB, with 57% of the YTD volume compared to 47% in IH 2019.

For FY 2019, we expect that CMBS volume will end the year somewhere between $86 billion and $91 billion, which would easily exceed the FY 2018 level of $75 billion. Looking ahead, we believe 2020 issuance could rise to about $95 billion, of which conduit totals $52 billion (55%) and SB at $43 billion (45%). For CRE CLOs, we project a year-end 2019 issuance volume of $19 billion-$21 billion before rising to $25 billion in 2020.

Our projection factors in recent CRE sales,

forecasted allocations as well as the competitive

landscape. CRE transaction sales remain healthy,

with $279.6 billion YTD September 30 for the retail,

office, multifamily, and industrial sectors compared

to $268.5 billion for the same period last year. This

amounts to a YoY increase of 4.2%, based on our

analysis of CoStar data. Of these property types,

only retail experienced a decline (1.3%), while

multifamily had the largest increase (6%).

Our projection factors in recent CRE sales,

forecasted allocations as well as the competitive

landscape. CRE transaction sales remain healthy,

with $279.6 billion YTD September 30 for the retail,

office, multifamily, and industrial sectors compared

to $268.5 billion for the same period last year. This

amounts to a YoY increase of 4.2%, based on our

analysis of CoStar data. Of these property types,

only retail experienced a decline (1.3%), while

multifamily had the largest increase (6%).

According to the 2H 2019 CRE investment outlook

from the National Real Estate Investors/Marcus &

Millichap Investment Sentiment Survey,

commercial real estate offers favorable returns

relative to other asset classes and there is an

abundance of capital to invest. The survey reported

that 92% of respondents plan to increase (61%) or maintain (31%) CRE investment over the next 12 months. In

addition, according to a Hodes Weill/Columbia University survey, global institutions are raising their weighted CRE

asset allocations to 10.6% in 2020, or about 100 bps higher than in 2015. These surveys indicate that the appetite

for CRE investments remains intact (see Figure 7).

With long-term interest rates at low levels, conduit loan activity is expected to increase in 2020. In addition, with the

increase in conduit issuance, we could see some of the potentially smaller SB loans ending up in conduit executions.

We believe SB issuance will close 2020 at the higher end of our 2019 levels and should continue to benefit from the

ability of the securitized market to finance loans that maybe too large for other lenders. A case in point are Blackstone’s

two industrial property securitizations which include the largest deal ($5.6 billion) since pre-crisis—BX Commercial

Mortgage Trust 2019-XLP—as well as a scheduled $4 billion deal for the pending acquisition of Colony Capital’s

industrial property unit. In addition, as we observed in 2019, SB fixed rate deals are becoming an increasing form of

execution, which could be indicative of institutional borrowers seeking to lock in long-term rates. In 2018, 19 out of

84 SB deals (23%) were fixed rate compared to YTD September 30, 2019, when 19 out of 54 SB deals (35%) issued

were fixed rate.

CRE CLO issuance activity is expected to increase in 2020 based on current deal announcements, investor appetite

for yield, and favorable pricing and terms for issuers relative to other capital sources. Value-add and opportunistic

real estate investments remain desirable asset classes, while the flexibility that short-term CRE CLO loans afford to

borrowers should bode well moving forward. However, this is a securitized segment that faces a challenging

competitive landscape. According to Preqin—an alternative investment data provider—60% of closed-end private

real estate funds as of Q3 2019 have targeted value add and opportunistic investments.

Freddie Mac has issued $333.6 billion of K-Series certificates, of which $41.3 billion was issued YTD September

2019. On a YoY comparison, the K-Series increased by a moderate 3.7%. The increase was partly tempered as

Freddie Mac curbed some activity to meet its 2019 multifamily lending cap of $35 billion. The caps were introduced

over concerns that the agencies were pushing out the private multifamily market. As of October 1, 2019, the revised

limit is set at $100 billion for the five quarters between Q4 2019 and YE 2020. The new cap will now apply to all

multifamily businesses—in the past, several categories (including small balance and affordable housing) were

exempt from prior limits. Despite the volume, credit performance has been strong. A review of Freddie Mac’s KDeal Performance tables as of September 2019 indicates that 99.96% of the K-Series deals are current.

Economy, CRE Fundamentals, and Pricing With the U.S. now in its 125th month of economic expansion—and with positive GDP growth expected to continue for the foreseeable future—expectations are for the current expansion to continue its record-setting trend. And while manufacturing activity fell to a 10-year low in September, based on the ISM Manufacturing Purchasing Manager’s Index, a strong labor market (including an unemployment rate that touched on a 50-year low in September) has kept the economy and CRE prices on a steady growth path. Even though the U.S. is exhibiting signs of a slowdown, it is still growing, although at a slower pace versus 2018. Real gross domestic product increased at an annual rate of 1.9% in Q3 2019 compared to 2% in the prior quarter and 2.9% in Q3 2018, according to the Bureau of Economic Analysis (see Figure 8). Cushman & Wakefield in their U.S. Market 2Q 2019 Beat Report expects real GDP growth to be in the mid 2% range for 2019, which it believes is still a healthy backdrop for CRE.

Overall, property fundamentals remain positive due to strong tenant demand and supply constraints. CoStar reported

that office, retail, and industrial deliveries as a percentage of inventory averaged 0.2% over the last four quarters, or

one-half of the levels seen in 2007-08. However, as with any sector, results will vary by asset type. While the

national vacancy rate for office and multifamily fell YoY in Q3 2019, rates increased for industrial and retail but

was flat for lodging. Furthermore, CoStar forecasts that vacancies through 2023 will continue to rise, while rent

growth will experience a slowdown. In addition, the Urban Land Institute (ULI) expects national vacancy rates to

rise modestly in 2019-2021 for all property types. ULI’s semiannual September 2019 Real Estate Economic Forecast

also expects rents to continue to grow modestly over the three-year period. In addition, industrial rent growth which

is expected to average 3% will lead all categories, followed by multifamily (2.5%), office (2.1%), hotels (1.4% in

revenue per available room (RevPAR)), and neighborhood and community centers (1.3%). Bricks and mortar retail

will continue to struggle due to e-commerce growth and store closures.

While CRE prices continue their upward trajectory in line with the wider economy, a slowdown in price growth is

not unexpected this late in the cycle. The CoStar Commercial Repeat-Sale Index (CCRSI) Equal Weighted U.S.

Composite Index increased 2.5% in Q3 2019 and 7.1% YoY. The equal weighted index weighs each transaction

equally, regardless of the value of the transaction. The Value Weighted U.S. Composite Index rose 0.5% in Q3 and

8.2% YoY. The value weighted index reflects larger asset sales that are common in core markets. Both indices,

however, have declined from the double-digit annual growth rates recorded earlier in the cycle, according to CoStar.

As of September 2019, the equal and value weighted indices when comparing trough to current prices are 103.6%

and 121.1% higher, respectively. Even with the run-up in values, the prevailing view is that the next recession will

be less severe than the last one, due to the slow and steady expansion that has occurred in this economic cycle.

Property Types

Office

Allison Werry | (646) 731-2321 | awerry@kbra.com

Nationally, the overall office vacancy rate fell YoY in Q3 2019 to 9.7% from 9.8% (see Figure 9). The decline

was the ninth consecutive year of falling vacancies since a high of 13.1% in 2010. The vacancy rate is expected to

remain below 10% through Q1 2022, which is relatively low compared to historical levels.

Average rental rates of $33.68 per square foot (sf)

reflect a 2.4% YoY increase as of Q3 2019, according

to CoStar. Technology and Sunbelt markets with

strong demographics continue to outperform,

including Austin (6.8% YoY rent growth), Charlotte

(6.4%), Seattle (6.3%), Jacksonville (5.6%), and East

Bay (5.5%). And while overall rent growth is

expected to remain positive on a national level, it will

likely slow to less than 2% in 2020 and 2021.

Average rental rates of $33.68 per square foot (sf)

reflect a 2.4% YoY increase as of Q3 2019, according

to CoStar. Technology and Sunbelt markets with

strong demographics continue to outperform,

including Austin (6.8% YoY rent growth), Charlotte

(6.4%), Seattle (6.3%), Jacksonville (5.6%), and East

Bay (5.5%). And while overall rent growth is

expected to remain positive on a national level, it will

likely slow to less than 2% in 2020 and 2021.

Construction completions are expected to reach 60.7

million sf in FY 2019, up 22.3% YoY from 49.6

million sf. Although absorption is forecast to

decrease 2.7% YoY, it should remain slightly

positive for FY 2019, resulting in a slight decline in

vacancies (see Figure 10). This absorption

momentum was partly due to multiple large-scale

tenants moving into new blocks of space, a trend that

is expected to continue over the next several quarters,

according to CoStar. Meanwhile, technology sector

tenants accounted for more than 26.4% of the leases

signed as of Q3 2019, or almost double the number

signed by financial services firms (13.7%), according

to Cushman & Wakefield.

The construction pipeline totaled 2.4% of U.S.

inventory as of Q3 2019, which is the largest share of

new construction since 2000, according to Cushman

& Wakefield. Markets where construction accounts

for the highest percentage of total inventory include

Austin (10.6%), San Mateo County, California

(10.3%), Nashville (10.1%), Charlotte (9.3%), Salt

Lake City (6%) and Midtown Manhattan (5.6%).

Office prices recorded a 2.4% increase in Q3 2019, based on CCRSI data. On a YoY period ending September

2019, office prices were up 3.8%. The CCRSI Prime Metro Index was up 3.5% YoY (see Figure 11).

WeWork’s recent financial challenges, including its

failed initial public offering (IPO), have drawn

further attention to co-working, or flexible office

space. Despite the noteworthy growth of this sector

in recent years, flexible office space accounts for less

than 1.8% of total U.S. inventory as of Q2 2019,

according to CBRE Group Inc. The U.S. markets

with the largest share of this sector are San Francisco

(4%) and Manhattan (3.6%). WeWork is the largest

private-sector tenant in Manhattan, where the

company leases approximately 7.2 million sf.

According to a September Wall Street Journal article,

the vast majority of NYC landlords do not want to

lease space to WeWork while the company is

struggling financially. It can also make it harder to get

financing as lenders become wary of lending on

buildings with large WeWork exposure. In addition,

if the company’s financial situation continues to

decline, landlords with significant exposure to WeWork could have difficulty re-leasing the tenant’s spaces at

equivalent rental rates, particularly if coupled with any economic softness.

WeWork’s recent financial challenges, including its

failed initial public offering (IPO), have drawn

further attention to co-working, or flexible office

space. Despite the noteworthy growth of this sector

in recent years, flexible office space accounts for less

than 1.8% of total U.S. inventory as of Q2 2019,

according to CBRE Group Inc. The U.S. markets

with the largest share of this sector are San Francisco

(4%) and Manhattan (3.6%). WeWork is the largest

private-sector tenant in Manhattan, where the

company leases approximately 7.2 million sf.

According to a September Wall Street Journal article,

the vast majority of NYC landlords do not want to

lease space to WeWork while the company is

struggling financially. It can also make it harder to get

financing as lenders become wary of lending on

buildings with large WeWork exposure. In addition,

if the company’s financial situation continues to

decline, landlords with significant exposure to WeWork could have difficulty re-leasing the tenant’s spaces at

equivalent rental rates, particularly if coupled with any economic softness.

KBRA expects office properties to experience positive performance through 2020 based on stable property

fundamentals. However, if there is a more pronounced slowdown in economic growth, it could have an outsized

impact on market fundamentals in cities with excess supply, exposure to the oil and gas sector, or weak population

and employment metrics.

Retail

Robert Grenda | (215) 882-5494 | rgrenda@kbra.com

The national retail vacancy rate rose to 4.5% in

Q3 2019, up 9 bps on a YoY basis, according to

CoStar data (see Figure 12). The vacancy rate has

tracked below 5% for 13 consecutive quarters and

under 6% for 21 straight quarters in a row. Net

completions are well below their pre-recession peak,

providing room for healthy net absorption that is being

driven by steady consumer spending and a stable

economy—despite a long list of tenant bankruptcies

and store closures over the past few years. Rent

growth on an annualized basis was modest at 1.3% in

Q3 2019 and is expected to inch above 1% in FY 2019,

CoStar reported. However, this is a sharp decline from

the prior six years, when average rent in the U.S. grew

by more than 2% annually.

The national retail vacancy rate rose to 4.5% in

Q3 2019, up 9 bps on a YoY basis, according to

CoStar data (see Figure 12). The vacancy rate has

tracked below 5% for 13 consecutive quarters and

under 6% for 21 straight quarters in a row. Net

completions are well below their pre-recession peak,

providing room for healthy net absorption that is being

driven by steady consumer spending and a stable

economy—despite a long list of tenant bankruptcies

and store closures over the past few years. Rent

growth on an annualized basis was modest at 1.3% in

Q3 2019 and is expected to inch above 1% in FY 2019,

CoStar reported. However, this is a sharp decline from

the prior six years, when average rent in the U.S. grew

by more than 2% annually.

Construction activity is anticipated to pick up going

forward. After falling more than 35% in 2018,

CoStar projects net completions will rise 4.6% in

2019 before dropping nearly 20% in 2020 (see

Figure 13). Completions are then projected to rise

38.8% in 2021 and 27.9% in 2022. Net absorption

is expected to drop nearly 41% in 2019 before

picking up again in 2020. The impact on vacancies

should be negligible but rent growth will be muted.

CoStar projects a little over 1% growth in 2020,

followed by below 1% growth starting in 2021 and

continuing through to at least 2025.

Construction activity is anticipated to pick up going

forward. After falling more than 35% in 2018,

CoStar projects net completions will rise 4.6% in

2019 before dropping nearly 20% in 2020 (see

Figure 13). Completions are then projected to rise

38.8% in 2021 and 27.9% in 2022. Net absorption

is expected to drop nearly 41% in 2019 before

picking up again in 2020. The impact on vacancies

should be negligible but rent growth will be muted.

CoStar projects a little over 1% growth in 2020,

followed by below 1% growth starting in 2021 and

continuing through to at least 2025.

Among major property types in CCRSI, the U.S.

retail sector recorded the weakest price appreciation

in Q3 2019, with a paltry YoY gain of 0.8%.

CoStar’s Prime Retail Metros Index fared much

better, up 3.5% over the same period (see Figure 14).

Muted construction activity and investor demand for

high-quality properties are the main drivers of price

appreciation in the major markets.

Despite steady U.S. economic growth and record

low unemployment, retailers announced plans in

2019 to close roughly 155 million sf of store

space—an all-time record—according to CoStar.

Planned closures reached a new peak of more than

10,000 stores as of October, suggesting that

retrenchment will continue in 2020, owing to the

retail sector’s major structural challenges of

changing consumer preferences, e-commerce’s

steady assault, and fierce competition.

Among major retail categories, department stores

will remain under heavy pressure. While total U.S.

retail sales increased 4% YoY in Q3 2019, sales at

department stores fell 5.6%, extending a run of 14

consecutive years of annual declines, according to U.S. Census Bureau data. But despite its woes, physical retail is

surviving and, in some cases, thriving. CoStar reports that public retailers on average posted same-store sales growth

in 2017 and 2018. Coupled with the fact that comparable store space has been shrinking, as result of the record

number of store closures, this suggests that retailers are boosting sales productivity as they selectively reduce store

counts. As the sector continues to evolve, big-box retailers and debt-ridden chains will shutter more

underperforming stores. This will provide some landlords an opportunity to backfill with smaller, more productive

tenants paying higher rents. Low unemployment and steady economic growth are expected to continue to provide

tailwinds for the sector.

Lodging

Laura Wolinsky | (646) 731-2379 | lwolinsky@kbra.com

Overall, U.S. lodging market fundamentals remain

positive with continued, albeit slow, RevPAR

growth of 0.7% through the YTD September 2019

period compared to prior year. The industry has

benefited from 112 months (out of the last 115

months) of RevPAR growth as of September 2019

(with the exclusion of September 2018, June 2019,

and September 2019 when there were slight

declines). U.S. occupancy and average daily rate

(ADR) are at all-time highs, although their rate of

growth has slowed considerably compared to prior

years (see Figure 15). National hotel demand and

supply growth are roughly equal, resulting in

flattening occupancy levels, with ADR being the

sole source of RevPAR growth. ADR increases are

also slowing and barely equate to inflation.

Overall, U.S. lodging market fundamentals remain

positive with continued, albeit slow, RevPAR

growth of 0.7% through the YTD September 2019

period compared to prior year. The industry has

benefited from 112 months (out of the last 115

months) of RevPAR growth as of September 2019

(with the exclusion of September 2018, June 2019,

and September 2019 when there were slight

declines). U.S. occupancy and average daily rate

(ADR) are at all-time highs, although their rate of

growth has slowed considerably compared to prior

years (see Figure 15). National hotel demand and

supply growth are roughly equal, resulting in

flattening occupancy levels, with ADR being the

sole source of RevPAR growth. ADR increases are

also slowing and barely equate to inflation.

A look at supply shows the total U.S. active pipeline at 661,000 rooms, up 9.1% YoY, according to Smith Travel

Research (STR) data (see Figure 16). The two top markets with the most rooms under construction as a percentage

of existing supply include Nashville (5,572 rooms, 12% of existing supply) and New York (14,437 rooms, 11% of

existing supply). However, the number of rooms under construction through August 2019 was approximately

207,000, which is still slightly below the historical peak of approximately 212,000 in December 2007.

Approximately 70% of the active pipeline is select-service construction. Hilton and Marriott brands account for

58% of the 207,000 in construction rooms.

Transaction volume decreased significantly for Q3 2019 for non-portfolio sales that are $10 million or greater.

According to the LW Hospitality Advisors Q3 2019 Major U.S. Hotel Sales Survey, there were 41 single asset

(13,100 hotel rooms) sale transactions totaling $3.72 billion or $283,000 per key. By comparison, the 2018 survey

identified 57 single asset (15,300 hotel rooms) sale transactions totaling $6.4 billion or $419,000 per room. LW

Hospitality reported that the U.S. hotel transaction market has slowed down with a growing disconnect between

seller prices and buyers’ bids.

According to CoStar, the U.S. Hospitality Index continues to exhibit steady growth (see Figure 17). In Q3 2019, it

increased 0.9%, up 7.9% YoY in the 12-month period ended September 2019.

While headwinds exist that could disrupt lodging

sector performance, industry experts are forecasting

that lodging fundamentals will remain positive

through 2020. Occupancy is at an all-time high,

although increases in supply are expected to

continue to tamper occupancy growth levels.

Moderate ADR growth will drive future increases,

resulting in positive RevPAR growth.

While headwinds exist that could disrupt lodging

sector performance, industry experts are forecasting

that lodging fundamentals will remain positive

through 2020. Occupancy is at an all-time high,

although increases in supply are expected to

continue to tamper occupancy growth levels.

Moderate ADR growth will drive future increases,

resulting in positive RevPAR growth.

Leading sector analysts expect continued supply

growth around or above the long-term average of

1.9% in both 2019 and 2020, resulting in a relatively

flat occupancy and only a slight increase in ADR.

RevPAR is expected to continue to grow in 2019

and 2020, albeit at the lowest levels since the Great

Recession (see Figure 18).

Multifamily

Gabriela Hodara | (646) 731-2499 | ghodara@kbra.com

Favorable rental housing demand, including steady

job growth and household formations, should

provide the sector with healthy property

fundamentals for the remainder of 2019 and into the

new year. As of September 2019, CoStar reported a

5.8% vacancy rate, which decreased from 6.1% on a

YoY comparison. The multifamily vacancy rate is

forecast to increase to 6.1% in the period to TTM

September 2020 but should remain below the 15-

year average vacancy rate of 6.4%. While vacancy

rates are expected to rise, apartment owners should

be able to continue raising rents—albeit modestly—

at current levels. Average rental rates of $1,355 per

unit reflect a 3.8% YoY increase and are projected to

rise 1.3% in 2020 (see Figure 19).

Favorable rental housing demand, including steady

job growth and household formations, should

provide the sector with healthy property

fundamentals for the remainder of 2019 and into the

new year. As of September 2019, CoStar reported a

5.8% vacancy rate, which decreased from 6.1% on a

YoY comparison. The multifamily vacancy rate is

forecast to increase to 6.1% in the period to TTM

September 2020 but should remain below the 15-

year average vacancy rate of 6.4%. While vacancy

rates are expected to rise, apartment owners should

be able to continue raising rents—albeit modestly—

at current levels. Average rental rates of $1,355 per

unit reflect a 3.8% YoY increase and are projected to

rise 1.3% in 2020 (see Figure 19).

According to the Freddie Mac Multifamily 2019 Midyear

Outlook, household demand continues to outpace total

supply. The U.S. Census Bureau reported a 1.4 million

increase in total households each year for the past three

years, which compares to 1.1 million housing units

completed over the same time period. Demographics and

lifestyle preferences continue to support the demand for

multifamily housing, with baby boomers looking to

downsize and millennials, as well as others, flocking to

more affordable rental units. This is supported by a survey

conducted by Freddie Mac in April 2019 indicating that

82% of renters believe that renting is more affordable than

owning, an increase of 15 points from its February 2018

survey. In addition, based on the low interest rates, strong

fundamentals and investor demand, Freddie Mac predicts

that multifamily originations will set another record year

in 2019 for a total origination volume of $311 billion,

representing a 9.1% YoY increase.

According to the Freddie Mac Multifamily 2019 Midyear

Outlook, household demand continues to outpace total

supply. The U.S. Census Bureau reported a 1.4 million

increase in total households each year for the past three

years, which compares to 1.1 million housing units

completed over the same time period. Demographics and

lifestyle preferences continue to support the demand for

multifamily housing, with baby boomers looking to

downsize and millennials, as well as others, flocking to

more affordable rental units. This is supported by a survey

conducted by Freddie Mac in April 2019 indicating that

82% of renters believe that renting is more affordable than

owning, an increase of 15 points from its February 2018

survey. In addition, based on the low interest rates, strong

fundamentals and investor demand, Freddie Mac predicts

that multifamily originations will set another record year

in 2019 for a total origination volume of $311 billion,

representing a 9.1% YoY increase.

While the multifamily market continues to moderate

from cyclical highs based on the concentration of new

supply, it has remained healthy so far in 2019.

Multifamily construction is expected to stay strong in

2019, then decelerate in 2020. New construction

deliveries forecasted for FY 2019 are estimated to

decrease 7.8% from the prior year; however, the 12-

month period represents the sixth consecutive year

since the Great Recession that more than 250,000 units

were scheduled to be delivered to the marketplace.

Absorptions are expected to continue the trend of

outpacing completions by 14.6% for FY 2019 (see

Figure 20). The multifamily sector has continued to

perform well despite the active development pipeline.

The mismatch of supply and demand for new

multifamily assets is expected to be short-lived due to

projected reductions in new construction, coupled with

continued demographic trends and above-average job growth for some metropolitan areas. As a result, multifamily

rental demand is forecasted to remain stable over the longer term.

According to CCRSI, the multifamily sector posted a 1.8% price increase in Q3 2019 (See Figure 21). For the 12-

month period ending September 2019, prices grew by 6.9%. For the same time period, the CCRSI Prime Metro

Index for multifamily increased by a slightly lower rate of 6.3%. Multifamily continues to maintain one of the

strongest property type indices in this cycle, according to CoStar.

Rental reform regulations have become one of the top multifamily issues in 2019 as governments try to solve housing

affordability issues, impacting both small landlords as well as institutional investors. With Oregon setting a precedent,

California and New York created new rent reform regulations this year. The level of uncertainty around the rental reform

laws is expected to impact investment sales and could cause price volatility as investors assess the impact of the new laws.

Industrial

Allison Werry | (646) 731-2321 | awerry@kbra.com

CoStar reported that the national industrial vacancy

rate increased to 5.1% in Q3 2019, up from 4.7% in

the prior year, marking the end to a nine-year period

of annual declines. Vacancy rates are anticipated to

increase to 5.7% by YE 2020 and 5.9% by YE 2021

due to unprecedented new supply combined with

moderate economic growth. Despite the expected

increase, these rates remain near all-time lows

(see Figure 22).

CoStar reported that the national industrial vacancy

rate increased to 5.1% in Q3 2019, up from 4.7% in

the prior year, marking the end to a nine-year period

of annual declines. Vacancy rates are anticipated to

increase to 5.7% by YE 2020 and 5.9% by YE 2021

due to unprecedented new supply combined with

moderate economic growth. Despite the expected

increase, these rates remain near all-time lows

(see Figure 22).

Average rental rates of $8.64 per sf reflect a YoY

increase of 5.1% as of Q3 2019, which is slightly

lower than the annual average increase dating back to

2015. Although growth is expected to slow to 3.9%

YoY in 2020, CoStar estimates that e-commerce will

continue to drive rents higher as demand for bulk

distribution and infill logistics product remains strong.

Affordable regional distribution locations such as

Providence, Stockton, Las Vegas, and Sacramento

have led market rent growth. According to Cushman

& Wakefield, the weighted average rents for logistical

product have increased at more than twice the rate of

overall industrial during the past year.

Last-mile distribution centers near areas with

significant population remain in high demand. A

340,000 sf, three-story logistics center is planned to

open in the Red Hook neighborhood of Brooklyn,

New York, in late 2020. When it opens, it will be the

tallest distribution center on the East Coast, according

to CoStar Group.

CoStar reports that industrial completions are

estimated to reach 253.4 million sf for FY 2019,

which reflects a 16.3% increase YoY. Absorptions

are expected to decline 41.5% YoY at 145.5 million sf in 2019, marking the first year since 2009 that completions

have exceeded absorption (see Figure 23). In addition, construction deliveries will likely reach record levels in Q4

2019 and Q1 2020, with more than 60% of this space developed on a speculative basis. Construction is currently

concentrated in seven markets where demand has been consistently strong. According to Cushman & Wakefield,

Dallas/Fort Worth, the Inland Empire, the Pennsylvania I-81 & I-78 Distribution Corridor, Chicago, Houston,

Atlanta, and Indianapolis account for more than 10 million sf under construction, or 44% of the pipeline.

Based on the CCRSI, industrial prices rose 3.4% on a

September 2019 YoY comparison. The CCRSI Prime

Metro Index indicated that price growth was higher at

5.0% YoY (see Figure 24).

Based on the CCRSI, industrial prices rose 3.4% on a

September 2019 YoY comparison. The CCRSI Prime

Metro Index indicated that price growth was higher at

5.0% YoY (see Figure 24).

KBRA expects industrial properties to continue to

have good performance through 2020, although new

supply will cause higher vacancy rates and limited

rent growth. Although strong consumer confidence

has driven online retail sales higher in recent years,

trade uncertainty and manufacturing weakness could

negatively impact this sector’s overall performance.

Conduit Credit Metrics

As conduit transactions continue to represent a

sizeable proportion of the CRE securitization

universe, they continue to be a good barometer of

credit conditions for newly originated loans. Figure 25

highlights the key credit metrics for KBRA-rated deals dating back to 2012. The figures, along with other deal

metrics, are available with the KBRA Comparative Analytic Tool (KCAT) spreadsheets that accompany our conduit

pre-sales and monthly Trend Watch publications.

*As of November 7, 2019. Source: KBRA After reaching a multiyear high in 2015 (102.9%), KBRA loan-to-value (KLTV) began to trend lower before edging up in 2018. However, its movement year-to-date has been more pronounced, at 97.6%. The Q4 2019 average through November 7, at 101.7%, has certainly impacted the overall statistic. Full-term IO loans have also been exhibiting a more noticeable movement reaching 58.1% YTD, an all-time high. This has contributed to the rise in debt service charges (DSCs), which increased to 2.03x YTD compared to 1.92x for FY 2018.

The following are highlights of key metrics that we observed among the CMBS conduits that KBRA has rated so far this year:

The KBRA IO Index trended upward in 1H 2019 to

64.2% from 58.7% in FY 2018. The index continued its

rise to 75.6% in Q4, reaching an all-time YTD high of

65.7%. The pool’s weighted average IO index provides

a measure of a transaction’s exposure to interest-only

loans. It is compiled for each transaction by first

calculating an IO index for each loan, which is the

number of IO payments divided by the loan term. The

increase in the IO index has been heavily influenced by

the growing proportion of full-term IOs which, when

added to the partial IOs, aggregated 82.1% YTD.

▪ In-Trust KLTV was 97.6% YTD, with an All-In Cutoff

KLTV of 104.6%. The All-In KLTV since 2014 has

been between 103.2% and 107.6%. Subordinate debt

during this period was somewhat more volatile from its

low of 22.8% in 2015 to 31% in 2017.

The KBRA IO Index trended upward in 1H 2019 to

64.2% from 58.7% in FY 2018. The index continued its

rise to 75.6% in Q4, reaching an all-time YTD high of

65.7%. The pool’s weighted average IO index provides

a measure of a transaction’s exposure to interest-only

loans. It is compiled for each transaction by first

calculating an IO index for each loan, which is the

number of IO payments divided by the loan term. The

increase in the IO index has been heavily influenced by

the growing proportion of full-term IOs which, when

added to the partial IOs, aggregated 82.1% YTD.

▪ In-Trust KLTV was 97.6% YTD, with an All-In Cutoff

KLTV of 104.6%. The All-In KLTV since 2014 has

been between 103.2% and 107.6%. Subordinate debt

during this period was somewhat more volatile from its

low of 22.8% in 2015 to 31% in 2017.

▪ YTD KDSC increased to 2.03x from 1.92x FY 2018,

which is the highest it has been since 2012, with 2017 closely behind at 2.0x. This year’s figure has been influenced

by the growing full-term IO exposure, as well as lower leverage loans that tend to have higher In-Trust KDSCs.

▪ YTD, the average proportion of loans secured by assets situated in primary markets rose by 280 bps to 50.6%

compared to 2018, while secondary and tertiary market exposure fell by 150 bps (36.3%) and 130 bps (13.1%),

respectively.3 This could reflect the flight to safety found in the higher capitalized, more liquid core markets.

▪ Single tenant concentrations reversed trend after rising for six consecutive years, falling 150bps to 17.9% YoY.

Despite this, the concentration remains elevated and is noteworthy as single-tenant properties present higher

credit risk than multi-tenant properties, since the sole source of income is generated by one lessee.

▪ Retail exposure reached an all-time low at 24.1% YTD 2019 compared to its 2.0 peak of 38.0% in 2012. Except

for lodging, all of the major property types picked up retails’ reduced exposure. Lodging is currently at its lowest

2.0 conduit contribution rate, at 11.9%. The highest exposure currently is office (35.1%), followed by retail and

multifamily (15.4%) which increased in Q4 (see Figure 26). The increase partly reflects Freddie Mac’s reduced

level of originations which began to be observed in September, as they did not want to surpass their 2019

multifamily lending cap of $35 billion. For the purposes of calculating property type exposure, we allocated

mixed-use assets to the property types based on the component uses of the individual properties. The allocation

generally relied on the relative economic contribution of each mixed-use component.

▪ KBRA’s capitalization rate declined to 9.08% YTD 2019 from 9.37% in 2018. This YTD figure is the lowest it

has been since 2012. This was partly attributable to the shift to primary markets, which tend to have a lower risk

profile than secondary and tertiary markets.

With both short- and long-term interest rates at favorable levels, overall CRE lending including securitized product should

remain strong in 2020. But, as we have recently experienced, the Federal Reserve has no qualms in adjusting its monetary

policy and if it becomes less accommodative, it could again cause disruptions in the lending and credit markets.

3 We identified 17 market tiers, which we define as areas with a market capitalization of over $75 billion. Primary markets that are among the largest MSAs were classified as

tier 1A markets, and include Boston, Chicago, Los Angeles, New York, San Francisco, and Washington D.C. KBRA considers these MSAs to be core infill urban markets

that offer investors superior liquidity relative to the rest of the nation. The remaining markets were classified as follows: tier 1B consists of the remaining 11 MSAs among

the primary markets; tier 2A consists of secondary MSAs that rank from 18 to 50 based on market capitalization while tier 2B secondary markets rank from 51 to 100. We

consider all other markets to be tertiary.

Surveillance

After a credit rating is assigned, the KBRA CMBS surveillance team actively monitors all outstanding CMBS

ratings for the life of each transaction. The KBRA surveillance team also conducts monthly reviews of its

outstanding CMBS ratings through the review of trustee, remittance, and servicer data as available via Trepp.

Depending on our findings from these reviews, as well as other information that we evaluate (including media news

and post-securitization events), a transaction may be selected for a review.

As of October 31, 2019, our surveillance portfolio included 5,025 CRE ratings across 465 transactions with a total

outstanding balance of $395 billion (see Figure 27). Conduit transactions comprised the largest transaction type

(56% of outstanding principal balance) followed by Freddie Mac K-Series (18%).

When reviewing our timeline of rating actions, there were no positive or negative rating actions effectuated in 2011

and 2012. Starting in 2013 and continuing through 2015, only upgrades were initiated. These were primarily due to

loan paydowns, defeasance, and improved collateral performance. In 2016, we had our first downgrades (11) which

continued but at fairly flat levels in 2017 (12). By 2018, downgrades had more than doubled (27) and YTD are

already higher by 70% (46). The downgrades have also tracked the upward trend in KBRA Loans of Concern (KLOCs), which ended 2017 at 602 (3.4% of KBRA outstanding principal balance at that time) and by October 2019

were 48% higher at 891 (3.9%). Of the 891 K-LOCs, retail had the largest number of loans (287), accounting for

almost one-third of the total.

K-LOCs identify loan credit risk well in advance of defaults and serve as an indicator of potential collateral problems

that could manifest into major issues down the road. While K-LOCs are only one consideration in the ratings

process, loss estimates on them can contribute to transaction downgrades.

Overall, ratings were stable YTD October 31 as 95.7% were affirmed. As forecasted in KBRA’s 2019 CMBS

Outlook—we correctly forecast that the upgrade/downgrade ratio would compress further in 2019. Year-to-date,

there were 117 upgrades and 46 downgrades (upgrade/downgrade ratio of 2.5 to 1) compared to FY 2018, when

there were 119 upgrades and 27 downgrades (4.4 to 1). However, when examining the rating actions by transaction

type, downgrades were dominated by conduit transactions (38), with the others among large loan deals (8).

While we would expect the upgrade/downgrade ratio to compress as transactions season and we get further along in the economic cycle, many of the downgrades so far were event-driven, reflecting oil price declines and the onset of e-commerce’s effect on brick and mortar retail.

KBRA’s rated universe comprises transactions from 2011 through to this year. The earlier vintages have benefited from strong price growth. For example, the 2012-2013 vintages experienced price increases of 91% and 79%, respectively through September. This contributed to the relatively strong upgrade/downgrade ratios. However, interrupting the positive trend was the collapse in West Texas Intermediate (WTI) oil prices. WTI, which peaked at $106.10 per barrel on June 6, 2014, fell almost 50% to $53.40 per barrel by year end. Along with its fall came significant declines in property operating net cash flow for properties located in the oil-related economies such as

North Dakota and Houston. Some of the event-driven

ratings impact that occurred in 2014 carried over to

vintage year 2015, as not all CMBS lenders had yet

to leave the oil patch (see Figure 29).

The Mall Effect: Store Closures, Loan

Maturities, and Modifications

In the YTD October 2019 period, two of the

downgrades (4.3% of total) moved to non-investment

grade from investment grade. Each were in a separate

transaction and both were lowered to BB (sf) and BB-

(sf), respectively, from their lowest investment-grade

class of BBB- (sf). The highest rating that was

downgraded YTD came from a third transaction and

moved to BBB (sf) from A- (sf). All three transactions

had retail malls driving the downgrades.

The Mall Effect: Store Closures, Loan

Maturities, and Modifications

In the YTD October 2019 period, two of the

downgrades (4.3% of total) moved to non-investment

grade from investment grade. Each were in a separate

transaction and both were lowered to BB (sf) and BB-

(sf), respectively, from their lowest investment-grade

class of BBB- (sf). The highest rating that was

downgraded YTD came from a third transaction and

moved to BBB (sf) from A- (sf). All three transactions

had retail malls driving the downgrades.

The CG-CCRE 2014-FL1 floating-rate large loan transaction, which was initially collateralized by three loans,

suffered from adverse selection as two of the better performing loans paid off, leaving the deal with the

underperforming Yorktown Center. The property, which is primarily collateralized by a super-regional mall,

transferred to the special servicer in October 2018 for imminent maturity default. The loan was subsequently modified

with a 12-month maturity extension to March 2020. In total, five classes were downgraded, including the BBB- (sf)

to BB (sf) rating. In addition, four of the five downgrades were on Watch Developing prior to the rating actions.

GSMS 2014-GC18 had four classes downgraded, including the BBB- (sf) rated class that moved to BB- (sf). The

Wyoming Valley Mall (8% of principal balance) is a super-regional mall located in Wilkes-Barre, Pennsylvania.

The property included two anchor tenants, Bon-Ton and Sears, which closed their stores. The loan was transferred

to the special servicer in June 2018 due to imminent monetary default. Based on our analysis, at the time of the

downgrades, KBRA Net Cash Flow (KNCF) had declined 38.8% since issuance. In addition to the estimated loss

for this K-LOC (69.4%), three other assets had loss estimates ranging from 10.9% to 54.8%. Prior to the downgrades,

the lowered rated classes were on Watch Downgrade.

The other notable mall deal that brought down the highest rated class YTD of A- (sf) to BBB (sf) was in the JPMCC

2014 DSTY transaction. The collateral consists of two loans each secured by separate phases of the Destiny USA

super-regional mall in Syracuse, New York. The loan was transferred to the special servicer in March 2019 for

imminent maturity default. Based on our analysis of the collateral, KNCF declined 24% since issuance, driving its

LTV to 111.8% from 82.7% at issuance. The loan was eventually modified with a one-year maturity extension

subject to its meeting a debt yield test. A cash flow sweep was also set up, with an initial deposit funded by the

borrower of $6 million.

Based on a review of 10-year loans that come due in 2020 ($2.7 billion), which was reported in our September 2019

Trend Watch, malls accounted for the largest percentage of the maturing population (35.5%). We believe that B/C

malls may struggle in finding financing as they have generally fallen out of favor except for top-tier malls with high

sales. Where inline sales per sf were available for this population, many properties fell within the $300 to $400

range. While the inline sales information was generally dated, it suggests that these mall loans may face refinancing

challenges which could potentially trigger downgrades for the deals that contain the underlying collateral.

With the length of the economic expansion continuing into uncharted territory and the Federal Reserve’s three rate

cuts so far in 2019, the positive momentum that CRE has experienced should carry over into 2020. This should help

to support property collateral performance and upgrades in the new year. However, as we believe that property

operating cash flows and valuations may have their best years behind them, upgrades may level off and even decline.

With the increasing levels of K-LOCs, more downgrades could follow due to property underperformance. These

factors should continue the compression in the upgrade/downgrade ratio that we have experienced over the last few

years into 2020.