Commercial real estate collateralized loan obligations (CRE CLO) experienced a third straight year of issuance growth in 2019. A total of $19.2 billion was securitized, representing a 40% year-over-year (YoY) growth rate and nearly eightfold increase since 2016 (see Figure 1). The sector has become a meaningful segment of the CRE securitization market, comprising approximately 20% of private label CRE securitizations.

In addition to the growth in dollar volume, Kroll Bond Rating Agency (KBRA) has observed many repeat issuers in 2019 as well as a healthy supply of inaugural issuers, including five out of 29 CRE CLO deals issued by new sponsors.

KBRA believes this is an appropriate time to reflect on how the sector has progressed, given the growth experienced by this evolving market. In this handbook, KBRA uses selected research reports we have published over the past 12 months as well as primers produced in 2018 to compile key topic points. Additionally, CRE CLO sponsor profiles for KBRA-rated transactions are included.

CRE CLO Research

Some of the developments discussed in the handbook and past research include:

Some of the developments discussed in the handbook and past research include:

- A highly competitive lending marketplace helped to drive rates lower.

- Collateral managers gained more flexibility in modifying performing loans.

- Relatively few defaults occurred in the benign economic environment, and issuers have purchased credit risk and defaulted mortgage assets to avoid failing par value tests.

- Despite the competitive lending environment and increasing level of asset transition, credit support has visibly eroded among non-KBRA rated transactions.

Among the most dramatic of shifts over the past few years is the transition to managed deals (see Figure 2). Managed transactions provide a nonrecourse, non-mark to market, and match-term funded ongoing stable source of financing for their loans. Managed CRE CLOs also help to reduce the overall cost of financing by permitting ramp-up and reinvestment of mortgage assets using issuance cash and principal proceeds. This allows the fixed costs of a CRE CLO to be spread over more loans and over a longer time period.

Among the most dramatic of shifts over the past few years is the transition to managed deals (see Figure 2). Managed transactions provide a nonrecourse, non-mark to market, and match-term funded ongoing stable source of financing for their loans. Managed CRE CLOs also help to reduce the overall cost of financing by permitting ramp-up and reinvestment of mortgage assets using issuance cash and principal proceeds. This allows the fixed costs of a CRE CLO to be spread over more loans and over a longer time period.

From a credit perspective, a managed transaction can benefit from ongoing, proactive asset management, particularly in times of distress. Collateral managers may also be permitted to direct the sale of defaulted and credit risk assets throughout the life of the deal. This can be accomplished by exchanging defaulted or credit risk assets for an asset owned by its affiliates, provided the exchange asset satisfies eligibility criteria. In contrast, reinvestment features can lead to negative credit migration, as well as increased concentration, over the term of a securitization. These risks are generally somewhat mitigated by eligibility criteria that include loan-to-value (LTV) and debt service coverage (DSC) hurdles, and property type and geographic concentration limitations, as well as the ability of rating agencies to provide rating agency confirmation that a contemplated collateral addition, in and of itself, would not cause a downgrade, qualification, or withdrawal of the rating.

In the next section, we highlight KBRA’s prior research publications and followed by information regarding the sponsors of KBRA-rated deals as well as some key transaction statistics.

CRE CLO-Related Research Reports

Below we highlight key themes from nine KBRA research reports on the sector. While some numbers and statistics have changed since the reports were issued, we believe the salient points are still applicable and provide a window into how the market has evolved.

CRE CLO Trend Watch: 2019 Issuance Up; Subordination Levels Down

Published: January 2020

This report highlighted 2019 issuance growth. Along with the positive news regarding increased volume, there were some negatives. The market continued to be characterized by increased competition, with many lenders and borrowers increasingly engaging in reposition plans that entailed increased levels of rehabilitation and construction. It was somewhat counterintuitive that subordination levels among non-KBRA rated transactions declined over the same period. These transactions had, on average, six points less AAA enhancement and 3.5% less BBB- subordination compared to KBRA-rated transactions.

Key credit metrics were compared between both KBRA-rated and non-KBRA rated deals. On average, the non-KBRA rated transactions have higher leverage, lower debt yields, are more concentrated, and are collateralized by more transitional loans. While the metrics in and of themselves for the non-KBRA rated pools are not significantly worse than those rated by KBRA, they certainly do not justify tighter enhancement levels. For more context, nearly half of the 2019 non-KBRA rated deals had subordination levels under 15%, which approaches or exceeds the leverage available to issuers from typical bank credit lines for similar type of loans—which generally range between 80% to 85% of loan balance.

View Report

CRE CLO Trend Watch: Issuance on Track to Surpass 2018; Performance Buoyed by Buyouts

Published: October 2019

The report covered general issuance trends, surveillance activity and reinvestment trends, as well as highlighted loan buyouts, paydowns, and noteholder consent changes. Some of these include:

- Low delinquency rates in CRE CLOs, partly due to the ability of the sponsor to purchase defaulted mortgage assets and credit risk mortgage assets out of the trust. The report included a list of known buyouts in KBRA-rated deals.

- The relatively high rate of optional redemptions among 2017 vintage deals.

- Positive changes to transaction governance as a result of investor feedback regarding issuers’ ability to change important terms in the indenture without affirmative consent. The changes varied across the deals noted in the report, with some that either limited the ability for the issuer to make any changes or others concerning specific provisions. There were also changes that made it easier for bondholders to deny a request or, at a minimum, made the process more transparent.

A Look at CRE CLO Re-Bridging

Published: October 2019

“Re-bridging” occurs when a borrower uses a new bridge loan to refinance an existing one—potentially with higher proceeds and/or a lower interest rate. At the time of the report, we observed a number of re-bridging transactions among KBRA-rated CRE CLO securitizations, although their occurrence was fairly limited on an overall basis. In the report, KBRA reviews two scenarios by which re-bridging occurs:

- The original loan is refinanced using another loan via the following methods: 1) the CRE CLO sponsor adds the newly refinanced loan back into the same transaction or into another one of their managed CRE CLOs, or 2) a different CRE CLO sponsor refinances it and subsequently adds the loan to a different transaction.

- Performing loan modifications. While this is not an outright refinancing of the loan, such modifications can achieve a similar outcome in a more cost-effective manner.

View Report

CRE CLO Trend Watch: Strong Q2 2019 Issuance as Deal Evolve and Loans Churn

Published: July 2019

The report provided insights into issuance trends, surveillance activity and reinvestment trends, as well as the following:

- Issuers continued to tweak deal provisions as the sector seasoned and managers sought ways to streamline and add flexibility to the reinvestment process. Some of this flexibility, however, can potentially allow for additional credit drift without some of the protections that have been built into earlier deals. One such evolution was the ability to effectuate performing loan modifications.

- A couple of firsts that were observed as of the report date, including one issuer who acquired a loan in which the chief executive of the CRE CLO issuer was also affiliated with the borrower, although such issuer took certain actions to mitigate the related conflict of interest. In addition, there was a delayed close asset which significantly changed from what was initially presented to KBRA and investors prior to securitization. KBRA had not observed the latter event among other deals it had rated at the time.

CRE CLO Ramp-Up: From Beginning to End With More of the Same ... So Far

Published: July 2019

The report examined 11 managed CRE CLOs rated by KBRA since 2017 that have incorporated ramp-up provisions, which were fairly common at that time. In addition to ramp-up being a common feature, the dollar amount was substantial. In the 11 transactions examined, ramp-up accounted for a total of $1.1 billion (16.2%) of the $6.7 billion in aggregate issuance.

Among the deals examined in the report, ramp-up assets had credit characteristics that were generally consistent with the initial pool. In the transactions that completed their ramp-up periods, deal-weighted average credit metrics had not meaningfully changed between issuance and ramp-up: KBRA loan-to-values (KLTVs) had not changed by more than 1.5%, KBRA debt yield (KDY) had generally stayed rangebound between one-tenth and two-tenths of a percent, and KBRA cap rates had moved less than 0.15%. Not surprisingly, consistent with what was observed with CRE CLOs in general, average loan spread compressed in all the deals after ramp-up.

View Report

CRE CLO Experiencing Sizeable Prepayments

Published: March 2019

CRE CLOs generally have flexible prepayment provisions. This adds to the challenge of determining the duration and maturity of CRE CLO notes. To help illuminate this topic, the report provides some insight into factors that influenced prepayment behavior by examining such activity in 2017 and 2018 transactions.

Key takeaways from the report are as follows:

- Length of the initial loan term is a leading indicator of when prepayment may occur. This was somewhat expected as lenders and borrowers are aware of the extent and timing of business plans and will generally structure loan terms that meet those needs.

- Factors that could influence the time it takes to achieve a business plan show up in a loan’s propensity to prepay. For example, larger properties or assets with more extensive business plans show slower prepay speeds, as expected. Similarly, loans with a future funding component typically pay off slower versus loans which are fully funded at securitization.

- There were also observable differences in prepayment speeds based on property type: Multifamily experienced the fastest prepayment speeds, while lodging and office were the slowest.

Managed CRE CLO Eligibility Criteria: An Inside Look

Published: January 2019

Eligibility criteria (EC)—a key component of a managed CRE CLO—are designed to allow collateral managers to shift and adapt to the ever-changing lending landscape, but also provide investors a loose framework to analyze how the pool’s credit and concentration could drift over time. The report reviews EC in managed CRE CLOs and discusses how they have varied among deals rated by KBRA since 2017.

View Report

As the issuance of post-crisis CRE CLO transactions began to surge ahead in 2018, KBRA published two industry leading research reports that focused on key themes in the space, including:

Something Old, Something New: A Synopsis of Post-Crisis CRE CLO Structural Features

Published: April 2018

The report provides a summary of the terms of the key structural features that have become prevalent across KBRA-rated CRE CLOs. These include the post-closing acquisition of assets, future funding obligations, advancing, coverage tests, events of default, and the disposition of defaulted assets.

View Report

CRE CLOs: A Primer, Today’s CRE CLOs Aren’t Yesterday’s CRE CDOs

Published: April 2018

The report highlights several aspects across the sector, including transaction volume, key structural features, and the underlying collateral. The report also contains a glossary of commonly used terms in the sector.

View Report

In addition to the above, KBRA provided live tweeting and a recap of the past two CREFC CRE CLO conferences. The links for the two recaps are available here: 2019 Recap and 2018 Recap.

CRE CLO Sponsor Profiles

This section covers active issuers who have at least one outstanding transaction rated by KBRA. The profiles are compiled from offering documents, publicly available information made available by the sponsors or affiliates, and KBRA internal information that was gathered during the rating process.

Annaly Commercial Real Estate Group, Inc.

Annaly Commercial Real Estate Group, Inc., the sponsor of the CRE CLOs, is a subsidiary of Annaly Capital Management, Inc. (Annaly, NYSE: NLY). The company is a diversified capital manager that invests in and finances residential and commercial assets. Annaly owns a portfolio of real estate-related investments, including mortgage pass-through certificates, collateralized mortgage obligations, credit risk transfer securities, other securities representing interests in or obligations backed by pools of mortgage loans, residential mortgage loans, mortgage servicing rights, commercial real estate assets and corporate debt.

Annaly Commercial Real Estate Group, Inc., the sponsor of the CRE CLOs, is a subsidiary of Annaly Capital Management, Inc. (Annaly, NYSE: NLY). The company is a diversified capital manager that invests in and finances residential and commercial assets. Annaly owns a portfolio of real estate-related investments, including mortgage pass-through certificates, collateralized mortgage obligations, credit risk transfer securities, other securities representing interests in or obligations backed by pools of mortgage loans, residential mortgage loans, mortgage servicing rights, commercial real estate assets and corporate debt.

Based on Annaly’s Third Quarter 2019 investor presentation, the company reported total assets under management of $133 billion. Annaly operates across four main businesses: Annaly Agency Group, Annaly Residential Group, Annaly Commercial Real Estate Group, and Annaly Middle Market Lending Group. As of September 30, 2019, Annaly Commercial Real Estate Group, Inc. and its affiliates have assets under management of $1.8 billion.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Arbor Realty Trust, Inc.

Arbor Realty SR, Inc., the sponsor of the CRE CLOs, is an indirect majority-owned subsidiary of Arbor Realty Trust, Inc. (Arbor, NYSE: ABR). Arbor is a nationwide real estate investment trust and direct lender which provides loan origination and servicing for multifamily, senior housing, health care, and other diverse commercial real estate assets. Headquartered in New York, Arbor manages a multibillion-dollar servicing portfolio, specializing in government-sponsored enterprise products. Arbor’s product platform also includes CMBS, bridge, mezzanine, and preferred equity lending.

Arbor Realty SR, Inc., the sponsor of the CRE CLOs, is an indirect majority-owned subsidiary of Arbor Realty Trust, Inc. (Arbor, NYSE: ABR). Arbor is a nationwide real estate investment trust and direct lender which provides loan origination and servicing for multifamily, senior housing, health care, and other diverse commercial real estate assets. Headquartered in New York, Arbor manages a multibillion-dollar servicing portfolio, specializing in government-sponsored enterprise products. Arbor’s product platform also includes CMBS, bridge, mezzanine, and preferred equity lending.

Arbor reported a structured business loan and investment portfolio of $4 billion as of September 30, 2019. A majority of the portfolio consists of bridge loans in the aggregate amount of $3.5 billion on 185 loans, an 18% increase over year-end 2018. In addition, multifamily loans comprise 77% of the overall portfolio.

Arbor Multifamily Lending, LLC (AML), a Delaware limited liability company and an affiliate of the sponsor, acts as the servicer and the special servicer of the mortgage asset in Arbor’s CRE CLO transactions. AML has a mortgage servicing portfolio of $20 billion as of September 30, 2019, which mainly comprises Agency loans originated by Arbor’s affiliates.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of September 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Argentic Investment Management LLC

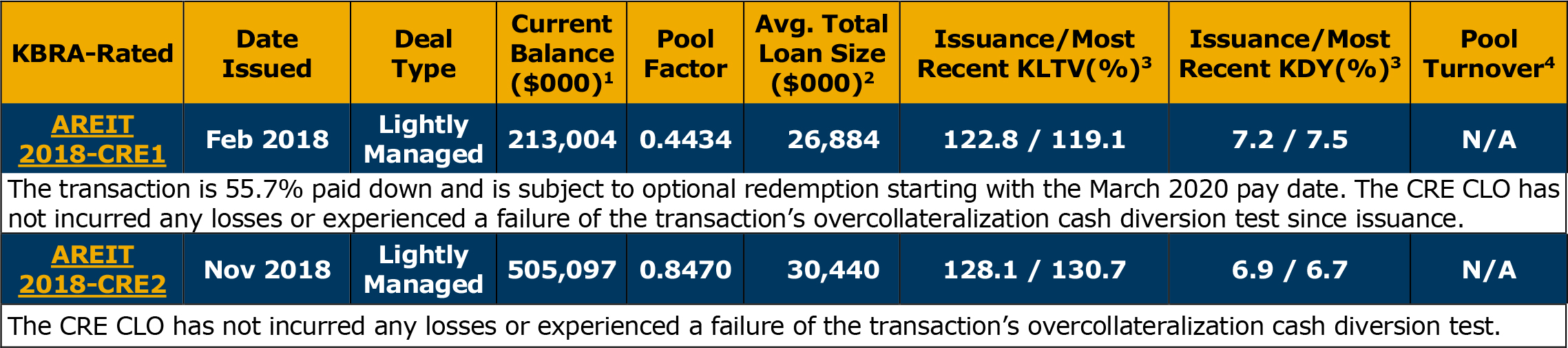

Argentic Real Estate Investment LLC (AREIT), the sponsor of the CRE CLOs, is managed by Argentic Investment Management LLC (Argentic), an SEC-registered investment adviser. Argentic is a fully-integrated, multi-strategy commercial real estate lending platform focused on delivering fixed rate and floating rate financing, including senior and subordinated loans, secured by real estate assets in the U.S. Argentic is an active participant in the CMBS market via providing loans to securitizations and from acquiring B-pieces, primarily as a risk retention sponsor.

Argentic Real Estate Investment LLC (AREIT), the sponsor of the CRE CLOs, is managed by Argentic Investment Management LLC (Argentic), an SEC-registered investment adviser. Argentic is a fully-integrated, multi-strategy commercial real estate lending platform focused on delivering fixed rate and floating rate financing, including senior and subordinated loans, secured by real estate assets in the U.S. Argentic is an active participant in the CMBS market via providing loans to securitizations and from acquiring B-pieces, primarily as a risk retention sponsor.

As of September 30, 2019, Argentic, on behalf of entities managed by it, has originated $8.9 billion of loans, securitized $5.8 billion in fixed rate CMBS transactions, purchased $1.3 billion in notional value of CMBS B-piece transactions, and securitized $1.8 billion of loans in three CRE CLOs.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of dates – CRE1 as of February 2019, CRE2 as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

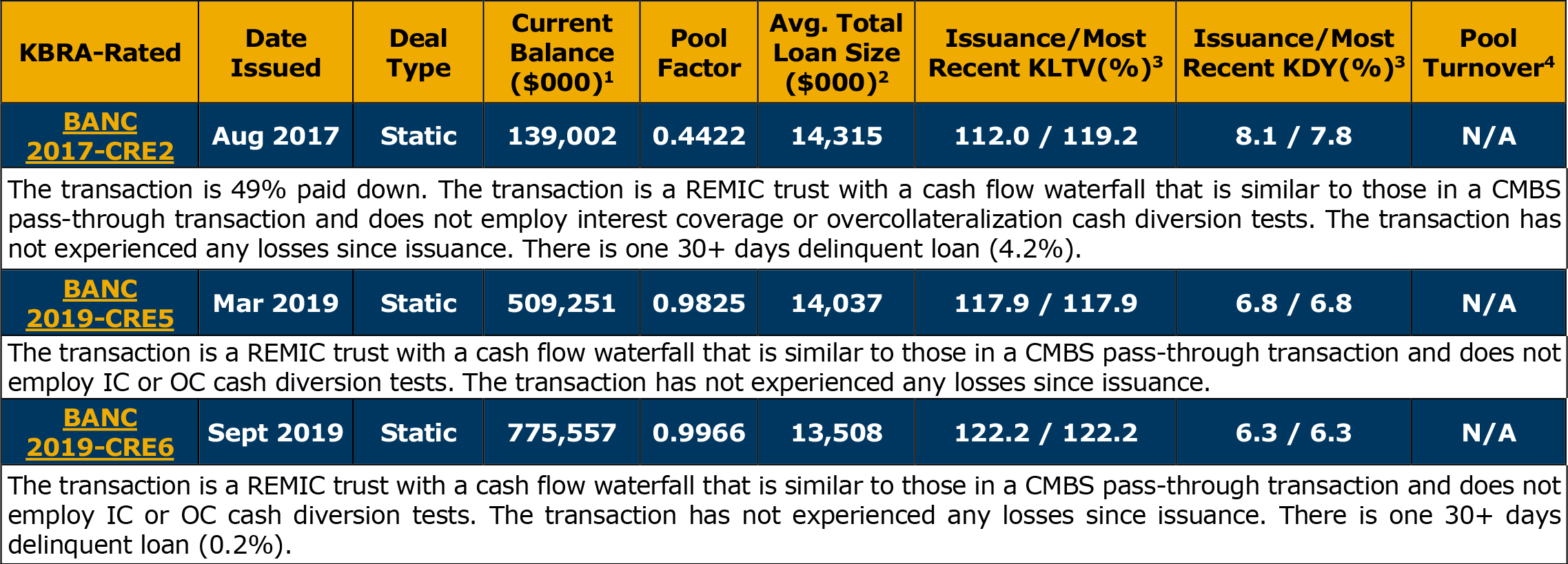

The Bancorp Bank

The Bancorp Bank (Bancorp), the sponsor of the transactions, is the primary operating subsidiary of The Bancorp, Inc. (NYSE: TBBK). Bancorp mainly originates commercial mortgage loans that are secured primarily by multifamily complexes, retail centers, office buildings, hotels, mixed-use buildings, and self-storage properties located in primary and secondary markets throughout the U.S. The Bancorp, Inc. specializes in providing private label banking for nonbank companies and offers four primary lines of specialty lending: securities-backed lines of credit (SBLOC), automobile fleet and other equipment leasing, small business administration (SBA) loans, and floating rate commercial real estate bridge loans.

The Bancorp Bank (Bancorp), the sponsor of the transactions, is the primary operating subsidiary of The Bancorp, Inc. (NYSE: TBBK). Bancorp mainly originates commercial mortgage loans that are secured primarily by multifamily complexes, retail centers, office buildings, hotels, mixed-use buildings, and self-storage properties located in primary and secondary markets throughout the U.S. The Bancorp, Inc. specializes in providing private label banking for nonbank companies and offers four primary lines of specialty lending: securities-backed lines of credit (SBLOC), automobile fleet and other equipment leasing, small business administration (SBA) loans, and floating rate commercial real estate bridge loans.

From 2012 to June 2019, Bancorp has contributed approximately $3.8 billion of commercial mortgage loans in 22 securitizations, including CMBS conduits. The company withdrew from the conduit CMBS market in 2016 but continues to focus on its CRE CLO strategy. As of June 2019, the company had total assets of approximately $4.6 billion and a market capitalization of approximately $506.4 million.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of dates – CRE2 as of August 2019, CRE5 as of Closing, and CRE6 as of closing.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

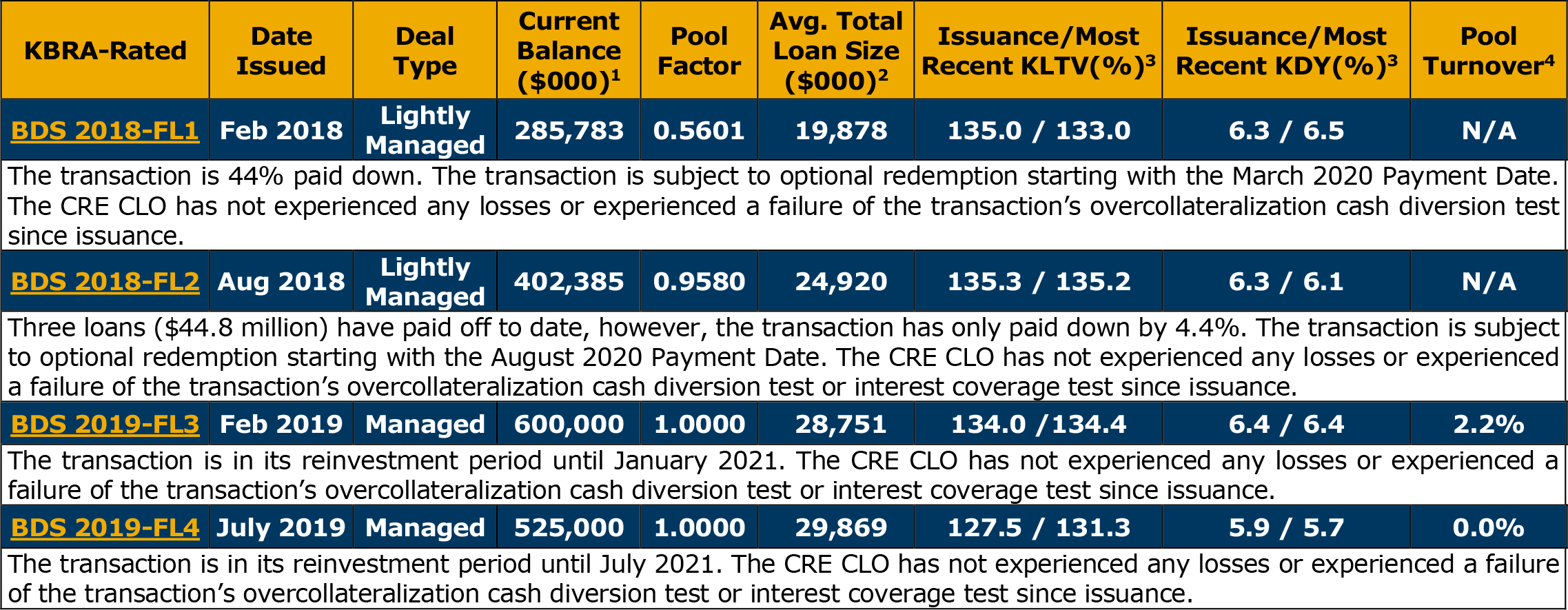

Benefit Street Partners LLC

Benefit Street Partners LLC (BSP) is a SEC-registered investment adviser with $27 billion in assets under management as of September 30, 2019. BSP manages Benefit Street Partners Realty Trust, Inc. (BSPRT), a publicly held, non-traded real estate investment trust, as its external advisor. BSP is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN) that together with its various subsidiaries operates as Franklin Templeton, which has approximately $700 billion in asset under management as of September 30, 2019. BSP, the collateral manager, and BSPRT’s platforms are complementary—the collateral manager’s platform consists primarily of long-term, fixed rate loans, while BSPRT’s platform focuses primarily on shorter-term floating rate loans and mezzanine investments.

Benefit Street Partners LLC (BSP) is a SEC-registered investment adviser with $27 billion in assets under management as of September 30, 2019. BSP manages Benefit Street Partners Realty Trust, Inc. (BSPRT), a publicly held, non-traded real estate investment trust, as its external advisor. BSP is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN) that together with its various subsidiaries operates as Franklin Templeton, which has approximately $700 billion in asset under management as of September 30, 2019. BSP, the collateral manager, and BSPRT’s platforms are complementary—the collateral manager’s platform consists primarily of long-term, fixed rate loans, while BSPRT’s platform focuses primarily on shorter-term floating rate loans and mezzanine investments.

BSP has closed approximately $8 billion in fixed and floating rate loans since the Real Estate team’s inception in 2014 through September 30, 2019. BSPRT has $2.5 billion of floating rate commercial real estate loans comprising 106 senior loans and three mezzanine loans as of September 30.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of dates – FL3 as of November 2019, FL4 as of October 2019, FL5 as of August 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Blackstone Mortgage Trust

Blackstone Mortgage Trust, which is structured as an externally managed REIT (NYSE: BXMT), is a commercial real estate finance and investment company that originates, underwrites, structures, acquires, manages, and distributes commercial mortgage loans and other real estate debt instruments across North America, Europe, and Australia. As of September 2019, BXMT had a portfolio totaling $16.4 billion in senior loans, which are largely secured by properties located primarily in New York, California, Illinois, the United Kingdom, and Spain. During the first nine months of 2019, BXMT originated approximately $3.7 billion of CRE loans with an average loan size of approximately $321 million.

Blackstone Mortgage Trust, which is structured as an externally managed REIT (NYSE: BXMT), is a commercial real estate finance and investment company that originates, underwrites, structures, acquires, manages, and distributes commercial mortgage loans and other real estate debt instruments across North America, Europe, and Australia. As of September 2019, BXMT had a portfolio totaling $16.4 billion in senior loans, which are largely secured by properties located primarily in New York, California, Illinois, the United Kingdom, and Spain. During the first nine months of 2019, BXMT originated approximately $3.7 billion of CRE loans with an average loan size of approximately $321 million.

The Blackstone Group (Blackstone) is the parent of BXMT and one of the largest multinational private equity firms in the world, with approximately $554 billion of assets under management as of September 2019. BXMT is one component within Blackstone’s real estate platform and is externally managed by BXMT Advisors L.L.C., a subsidiary of Blackstone. BXMT Advisors L.L.C. has a total of approximately $157 billion of capital under management.

CT Investment Management Co., LLC (CITM), the special servicer, is a wholly owned subsidiary of Blackstone and only provides special servicing and asset management to Blackstone. CITM’s activities are effectuated by employees, technology and control processes within the Blackstone Real Estate Debt Strategies Group.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of December 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Bridge Debt Strategies Fund Manager LLC

Bridge Debt Strategies Fund Manager LLC (BDS) is a SEC-registered investment adviser with $5.9 billion in assets under management as of September 30, 2019, and is the external manager of Bridge REIT, the sponsor of the transactions. The collateral manager’s management platform consists primarily of short-term, floating-rate, Freddie Mac B-piece securities (both floating and fixed rate), and short- to medium-term mezzanine investments.

Bridge Debt Strategies Fund Manager LLC (BDS) is a SEC-registered investment adviser with $5.9 billion in assets under management as of September 30, 2019, and is the external manager of Bridge REIT, the sponsor of the transactions. The collateral manager’s management platform consists primarily of short-term, floating-rate, Freddie Mac B-piece securities (both floating and fixed rate), and short- to medium-term mezzanine investments.

BDS is a majority-owned subsidiary of Bridge Investment Group (Bridge), a private equity real estate investment and property management firm. As of September 30, 2019, Bridge reported total assets under management of $20.1 billion.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of dates – FL1 as of February 2019, FL2 as of August 2019, FL3 as of July 2019, and FL4 as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

DoubleLine Capital LP

DoubleLine Capital LP (DoubleLine), the collateral manager, is a Delaware limited partnership that is a registered investment adviser. The firm, which is headquartered in Los Angeles, had over $147 billion in assets under management as of September 30, 2019, and manages a broad range of investment vehicles across multiple strategies including structure products and fixed income products. The firm has established relationships with various third-party originators to source potential CRE investments. However, DoubleLine drives all structuring decisions and negotiations pre-closing.

DoubleLine Capital LP (DoubleLine), the collateral manager, is a Delaware limited partnership that is a registered investment adviser. The firm, which is headquartered in Los Angeles, had over $147 billion in assets under management as of September 30, 2019, and manages a broad range of investment vehicles across multiple strategies including structure products and fixed income products. The firm has established relationships with various third-party originators to source potential CRE investments. However, DoubleLine drives all structuring decisions and negotiations pre-closing.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Exantas Capital Corp.

Exantas Capital Corp. (NYSE: XAN), formerly Resource Capital Corp., is a publicly traded commercial mortgage real estate investment trust. XAN is externally managed by Resource America, Inc., which was acquired by C-III Capital Partners, LLC (C-III) in September 2016. Overall, the commercial mortgage business of XAN is carried out by Resource Real Estate Funding, LLC (RREF), a subsidiary of Resource America. RREF serves as the dedicated originator and asset manager for XAN, and only originates and manages CRE debt investments on behalf of XAN.

Exantas Capital Corp. (NYSE: XAN), formerly Resource Capital Corp., is a publicly traded commercial mortgage real estate investment trust. XAN is externally managed by Resource America, Inc., which was acquired by C-III Capital Partners, LLC (C-III) in September 2016. Overall, the commercial mortgage business of XAN is carried out by Resource Real Estate Funding, LLC (RREF), a subsidiary of Resource America. RREF serves as the dedicated originator and asset manager for XAN, and only originates and manages CRE debt investments on behalf of XAN.

As of September 2019, XAN had approximately $2.5 billion of assets under management. XAN’s core investment strategy is to originate transitional CRE loans such that substantially all of its $1.8 billion CRE loan portfolio comprises floating rate senior whole loans.

C-III Asset Management LLC, the servicer and special servicer, is a wholly owned subsidiary of C-III. As of June 30, 2019, its primary servicing portfolio totaled $2.6 billion across 170 assets and its active special servicing portfolio was $3.7 billion across 186 assets, which includes both loans and REO assets.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of June 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Fortress Investment Group LLC

Drawbridge Special Opportunities Fund LP (Drawbridge), the transaction sponsor, is a credit hedge fund that is managed by an affiliate of FIG LLC, an SEC registered investment adviser and an affiliate of Fortress Investment Group LLC (Fortress). Fortress is an investment manager specializing in asset-based investing across a diverse set of asset types with a reported $41.5 billion of assets under management as of September 30, 2019. Fortress was acquired by SoftBank Group Corp. (NYSE: SFTBY) in December 2017.

Drawbridge Special Opportunities Fund LP (Drawbridge), the transaction sponsor, is a credit hedge fund that is managed by an affiliate of FIG LLC, an SEC registered investment adviser and an affiliate of Fortress Investment Group LLC (Fortress). Fortress is an investment manager specializing in asset-based investing across a diverse set of asset types with a reported $41.5 billion of assets under management as of September 30, 2019. Fortress was acquired by SoftBank Group Corp. (NYSE: SFTBY) in December 2017.

FORT CRE Special Servicing LLC, the special servicer, is wholly owned by Drawbridge. As of September 30, 2019, Fortress has two core businesses: Credit and Private Equity. Drawbridge is managed within the Credit business of Fortress.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of December 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

FS Real Estate Advisor / Rialto Management Group, LLC

FS Credit Real Estate Income Trust, Inc. (FSCREIT), the transaction sponsor and collateral manager, is a non-listed public net asset value (NAV) REIT focused on investing in senior secured, floating rate commercial real estate loans in the United States. FSCREIT is managed by its investment adviser, FS Real Estate Advisor, LLC, a subsidiary of FS Investments. Asset manager FS Investments focuses on alternative investment products with more than $24 billion of assets under management. The adviser has engaged Rialto Capital Management, LLC (RCM), a subsidiary of Rialto Management Group, LLC (Rialto), to act as sub-advisor to FSCREIT. RCM is a real estate investment and asset management company that invests and manages assets throughout the capital structure in real estate properties, loans, and securities. RCM has $4.6 billion in total assets under management.

FS Credit Real Estate Income Trust, Inc. (FSCREIT), the transaction sponsor and collateral manager, is a non-listed public net asset value (NAV) REIT focused on investing in senior secured, floating rate commercial real estate loans in the United States. FSCREIT is managed by its investment adviser, FS Real Estate Advisor, LLC, a subsidiary of FS Investments. Asset manager FS Investments focuses on alternative investment products with more than $24 billion of assets under management. The adviser has engaged Rialto Capital Management, LLC (RCM), a subsidiary of Rialto Management Group, LLC (Rialto), to act as sub-advisor to FSCREIT. RCM is a real estate investment and asset management company that invests and manages assets throughout the capital structure in real estate properties, loans, and securities. RCM has $4.6 billion in total assets under management.

Rialto Capital Advisors, LLC (RCA), the special servicer, is an affiliate of RCM. As of September 30, 2019, RCA was named special servicer on over 100 CMBS pools with an aggregate unpaid principal balance of $115 billion.

1 As of closing.

1 As of closing.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of closing.

4 Pool Turnover % = (UPB of new assets since issuance + current cash - ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Granite Point Mortgage Trust Inc.

Granite Point Mortgage Trust Inc. (NYSE: GPMT), the transaction sponsor, is a publicly traded commercial mortgage real estate investment trust. GPMT is externally managed by Pine River Capital Management L.P. (PRCM), a global alternative investment firm.

Granite Point Mortgage Trust Inc. (NYSE: GPMT), the transaction sponsor, is a publicly traded commercial mortgage real estate investment trust. GPMT is externally managed by Pine River Capital Management L.P. (PRCM), a global alternative investment firm.

As of September 2019, GPMT’s investment portfolio consisted of 116 commercial real estate loans with an aggregate balance of $4 billion and an additional $667 million of potential future funding obligations. The portfolio is comprised primarily of floating rate senior debt.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY – FL1 as of May 2019 and FL2 as of October 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Greystone & Co.

Greystone Senior Debt Opportunity OP, the transaction sponsor, is affiliated with Greystone & Co. (Greystone), a real estate lending, investment, and advisory company. As of December 2019, Greystone reported total assets under management of over $40 billion. Of the $39 billion of outstanding CRE loans originated and serviced by Greystone, approximately $1.4 billion are bridge loans, which are secured by multifamily properties and senior housing projects.

Greystone Senior Debt Opportunity OP, the transaction sponsor, is affiliated with Greystone & Co. (Greystone), a real estate lending, investment, and advisory company. As of December 2019, Greystone reported total assets under management of over $40 billion. Of the $39 billion of outstanding CRE loans originated and serviced by Greystone, approximately $1.4 billion are bridge loans, which are secured by multifamily properties and senior housing projects.

Greystone Servicing Company, LLC (GSC) is an affiliate of the transaction sponsor. GSC reported a portfolio of serviced commercial and multifamily mortgage loans (including loan in securitizations and loans owned by other investors) totaling $39 billion across 5,006 loans as of December 31, 2019.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of September 2019, following ramp-up completion.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Hunt Commercial Mortgage Trust

Hunt Investment Management, LLC (Hunt-IM) is a SEC-registered investment adviser with $3.6 billion of real estate assets under management, with a particular focus on multifamily investments. The Hunt-IM is a subsidiary of Hunt Companies, Inc. and external investment manager of Hunt Companies Finance Trust, Inc. (HCFT), which is the ultimate parent of the sponsor, Hunt Commercial Mortgage Trust. ORIX Corporation USA, a global financial services firm and subsidiary of Japan-based ORIX Corporation, announced on November 4, 2019, that it signed a definitive agreement to acquire Hunt Real Estate Capital, LLC, a subsidiary of Hunt Companies, Inc, and the investment management contract for Hunt Companies Finance Trust, Inc. from Hunt-IM (see ORIX Capital Markets’ profile for more details on ORIX). At this juncture, the operations and management of Hunt’s CRE CLOs is not expected to change in the immediate future.

Hunt Investment Management, LLC (Hunt-IM) is a SEC-registered investment adviser with $3.6 billion of real estate assets under management, with a particular focus on multifamily investments. The Hunt-IM is a subsidiary of Hunt Companies, Inc. and external investment manager of Hunt Companies Finance Trust, Inc. (HCFT), which is the ultimate parent of the sponsor, Hunt Commercial Mortgage Trust. ORIX Corporation USA, a global financial services firm and subsidiary of Japan-based ORIX Corporation, announced on November 4, 2019, that it signed a definitive agreement to acquire Hunt Real Estate Capital, LLC, a subsidiary of Hunt Companies, Inc, and the investment management contract for Hunt Companies Finance Trust, Inc. from Hunt-IM (see ORIX Capital Markets’ profile for more details on ORIX). At this juncture, the operations and management of Hunt’s CRE CLOs is not expected to change in the immediate future.

HCFT, as of September 30, 2019, reported an investment portfolio that includes $559.5 million in floating rate CRE loans with 92% of it secured by multifamily properties. Based on current outstanding CRE CLO balances and the portfolio of loans as of September 30, 2019, a large portion of the portfolio is financed via the CLOs. The higher CRE CLO outstanding balance versus HCFT’s loan balance is primarily cash-held by the CLOs for reinvestment activity.

Hunt Servicing Company LLC, an affiliate of Hunt-IM, acts as sub-servicer and special servicer on the CRE CLOs. As of year-end 2019, Hunt Servicing reported a servicing portfolio of approximately $17.3 billion on more than 3,100 loans.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

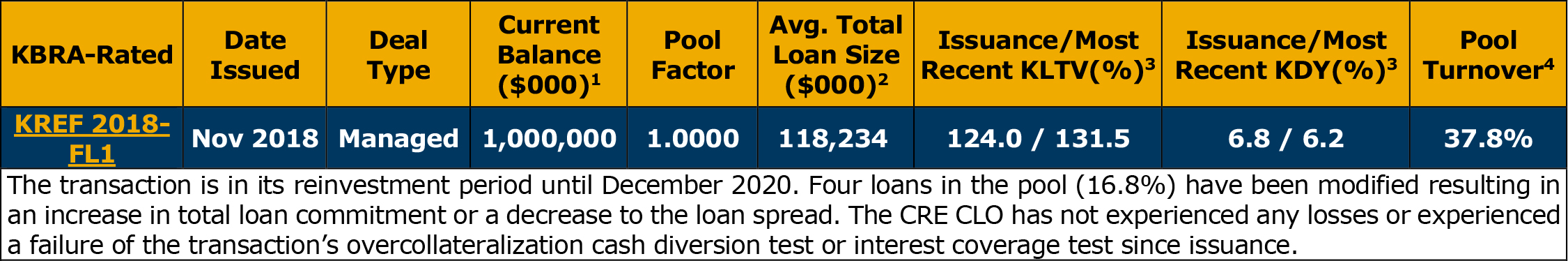

KKR Real Estate Finance Trust

KKR Real Estate Finance Holdings LP the transaction sponsor, is a subsidiary of KKR Real Estate Finance Trust, Inc. (KREF). KREF is a publicly traded real estate investment trust and managed externally by KKR Real Estate Finance Manager LLC, an indirect subsidiary of KKR & Co. Inc (NYSE: KKR). KKR is a global investment firm that manages multiple alternative asset classes with $208.4 billion of assets under management as of September 30, 2019.

KKR Real Estate Finance Holdings LP the transaction sponsor, is a subsidiary of KKR Real Estate Finance Trust, Inc. (KREF). KREF is a publicly traded real estate investment trust and managed externally by KKR Real Estate Finance Manager LLC, an indirect subsidiary of KKR & Co. Inc (NYSE: KKR). KKR is a global investment firm that manages multiple alternative asset classes with $208.4 billion of assets under management as of September 30, 2019.

As of September 2019, KREF reported a total portfolio of $5.2 billion comprised almost exclusively of senior floating rate commercial real estate senior loans. This does not include a future funding commitment of $551.8 million. The loans are primarily secured by multifamily (56%) and office (32%) properties.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of December 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

LoanCore Capital Credit REIT LLC

LoanCore Capital Credit REIT LLC (LCC REIT), the transaction sponsor, is a publicly registered commercial mortgage REIT focused on acquiring, originating, and managing a portfolio of commercial real estate debt. It is externally managed by LoanCore Capital Credit Advisor LLC (LoanCore). The ownership of LCC REIT includes two sovereign wealth funds, the Government of Singapore Investment Group, and the Canada Pension Plan Investment Board.

LoanCore Capital Credit REIT LLC (LCC REIT), the transaction sponsor, is a publicly registered commercial mortgage REIT focused on acquiring, originating, and managing a portfolio of commercial real estate debt. It is externally managed by LoanCore Capital Credit Advisor LLC (LoanCore). The ownership of LCC REIT includes two sovereign wealth funds, the Government of Singapore Investment Group, and the Canada Pension Plan Investment Board.

As of September 30, 2019, LCC REIT held approximately $6.7 billion of commercial real estate loans.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of October 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

Marathon Asset Management, L.P.

Marathon Asset Management L.P. (Marathon) and its affiliates act as a sponsor, special servicer, and collateral manager for the transaction. Marathon focuses on investing in the global credit markets, including corporate debt, bank debt and bonds, special situations and distressed debt, structured debt markets, and emerging market debt. As of September 2019, the firm had total assets under management of approximately $16.9 billion, of which real estate accounts for $2.3 billion.

Marathon Asset Management L.P. (Marathon) and its affiliates act as a sponsor, special servicer, and collateral manager for the transaction. Marathon focuses on investing in the global credit markets, including corporate debt, bank debt and bonds, special situations and distressed debt, structured debt markets, and emerging market debt. As of September 2019, the firm had total assets under management of approximately $16.9 billion, of which real estate accounts for $2.3 billion.

As special servicer, Marathon has a staff that focuses on loan servicing oversight, surveillance, asset management, and workouts.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

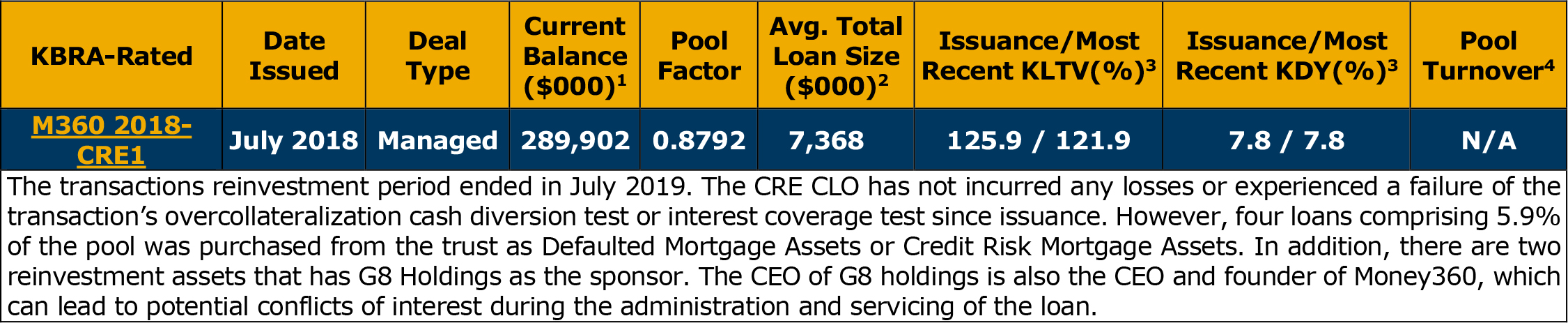

Money360 Inc.

M360 Advisors, LLC (M360) is an asset management company with over $900 million in assets under management. M360 manages a vertically integrated credit strategy that targets short duration commercial mortgage assets sourced from its affiliated origination company, Money360, Inc.

M360 Advisors, LLC (M360) is an asset management company with over $900 million in assets under management. M360 manages a vertically integrated credit strategy that targets short duration commercial mortgage assets sourced from its affiliated origination company, Money360, Inc.

Money360, Inc. is a nationwide direct lender that focuses on small to mid-balance commercial real estate loans ranging from $3 million to $30 million. As of December 31, 2019, Money360 Inc. has originated $1.7 billion of commercial real estate loans since inception.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of August 2019.

4 Pool Turnover % = UPB of new assets since issuance + current cash – ramp-up proceeds, N/A if not Managed or if after reinvestment period.

ORIX Capital Markets, LLC

ORIX Capital Markets, LLC, the transaction sponsor, is affiliated with ORIX RE Holdings, LLC, the collateral manager. ORIX RE Holdings, LLC is a proprietary trading/investment and asset management arm of ORIX Corporation USA (ORIX-USA). ORIX-USA, a Dallas-based, nonbank financial conglomerate that is both a debt provider and equity investor. The collateral manager, with and through its subsidiaries, invests in asset-backed securities, structured real estate transactions, and other structured financing transactions, as well as synthetic credit products. The collateral manager has approximately $1 billion in assets as of November 30, 2019.

ORIX Capital Markets, LLC, the transaction sponsor, is affiliated with ORIX RE Holdings, LLC, the collateral manager. ORIX RE Holdings, LLC is a proprietary trading/investment and asset management arm of ORIX Corporation USA (ORIX-USA). ORIX-USA, a Dallas-based, nonbank financial conglomerate that is both a debt provider and equity investor. The collateral manager, with and through its subsidiaries, invests in asset-backed securities, structured real estate transactions, and other structured financing transactions, as well as synthetic credit products. The collateral manager has approximately $1 billion in assets as of November 30, 2019.

ORIX Real Estate Capital, LLC (OREC), a Delaware limited liability company, is the servicer and special servicer, as well as an indirect wholly owned subsidiary of the Sponsor. OREC provides servicing, special servicing, and asset management services only to affiliated companies. As of November 30, 2019, OREC was servicing 3,759 commercial and multifamily real estate loans with an outstanding principal balance of approximately $26.6 billion.

ORIX-USA announced on November 4, 2019, that it signed a definitive agreement to acquire Hunt Real Estate Capital, LLC, a subsidiary of Hunt Companies, Inc, and the investment management contract for Hunt Companies Finance Trust, Inc. from Hunt-IM (see Hunt Commercial Mortgage Trust’s profile for more details on Hunt). At this juncture, the operations and management of ORIX’s CRE CLOs is not expected to change in the immediate future.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of December 2019.

4 Pool Turnover % = UPB of new assets since issuance + current cash – ramp-up proceeds, N/A if not Managed or if after reinvestment period.

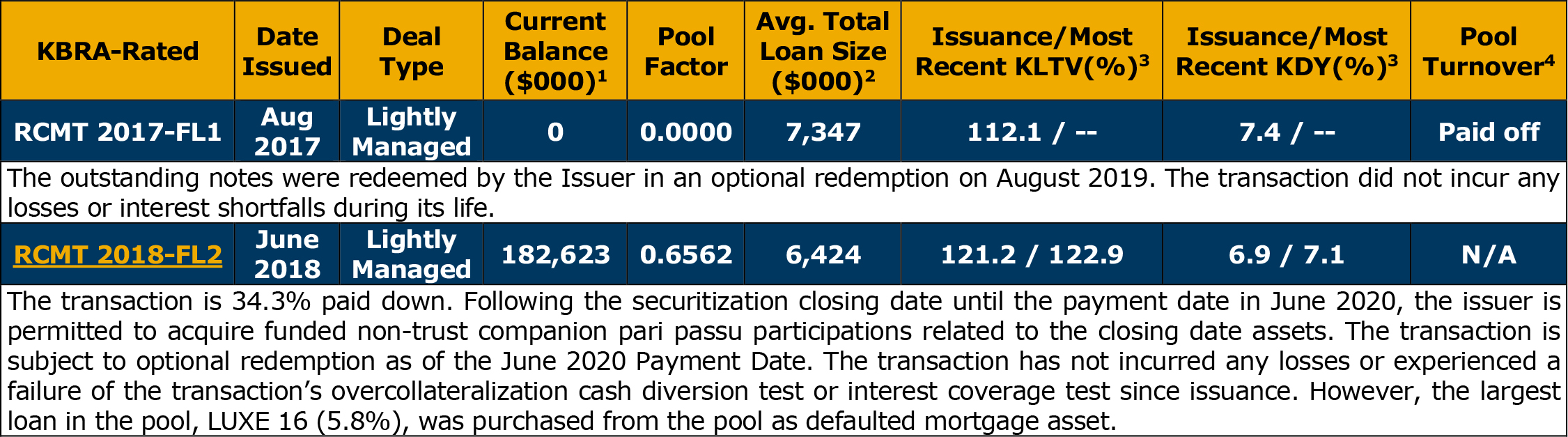

Ready Capital Corporation

Ready Capital Corporation (NYSE: RC), the transaction sponsor, is a publicly traded REIT incorporated in Maryland and formerly known as Sutherland Asset Management Corp. RC is externally managed and advised by Waterfall Asset Management, LLC, an investment adviser registered with the SEC. ReadyCap Commercial, LLC (ReadyCap) is the originator of the mortgages and a wholly owned subsidiary of Sutherland Partners, LP., the general partner of which is RCC.

Ready Capital Corporation (NYSE: RC), the transaction sponsor, is a publicly traded REIT incorporated in Maryland and formerly known as Sutherland Asset Management Corp. RC is externally managed and advised by Waterfall Asset Management, LLC, an investment adviser registered with the SEC. ReadyCap Commercial, LLC (ReadyCap) is the originator of the mortgages and a wholly owned subsidiary of Sutherland Partners, LP., the general partner of which is RCC.

Since its founding in September 2012 and its first loan origination in March 2013, ReadyCap has closed on approximately 1,082 commercial real estate mortgage loans, with an aggregate original principal balance of approximately $3.7 billion across all of its loan programs through March 1, 2019. Ready Capital Structured Finance, the bridge lending division of ReadyCap, has closed on approximately 183 mortgage loans, with an aggregate original principal balance of approximately $1.4 billion in its bridge loan program through March 1, 2019.

1 As of November 2019 pay date.

1 As of November 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of June 2019.

4 Pool Turnover % = UPB of new assets since issuance + current cash – ramp-up proceeds, N/A if not Managed or if after reinvestment period.

Shelter Growth Capital Partners LLC

Shelter Growth Capital Partners LLC (SGCP) is a credit-focused, SEC-registered, investment management platform that is dedicated to building and managing diversified portfolios of mortgage-related instruments and other structured products.

Shelter Growth Capital Partners LLC (SGCP) is a credit-focused, SEC-registered, investment management platform that is dedicated to building and managing diversified portfolios of mortgage-related instruments and other structured products.

SGCP and its affiliates has funded approximately $2.3 billion of CRE loans since inception, consisting of approximately $1.4 billion of bridge loans and $866 million of mezzanine loans. The company targets loans secured by stabilized or transitional commercial properties.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of dates – FL1 as of January 2016, FL2 as of closing.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.

TPG RE Finance Trust, Inc.

TPG RE Finance Trust Holdco, LLC, the transaction sponsor, is a wholly owned subsidiary of TPG RE Finance Trust, Inc (NYSE: TRTX). TRTX is a publicly traded commercial mortgage real estate investment trust. TPG RE Finance Trust Management, L.P. is an affiliate of TPG Global, LLC (TPG), a leading global alternative investment firm, and the external advisor of TRTX and the collateral manager of the transaction.

TPG RE Finance Trust Holdco, LLC, the transaction sponsor, is a wholly owned subsidiary of TPG RE Finance Trust, Inc (NYSE: TRTX). TRTX is a publicly traded commercial mortgage real estate investment trust. TPG RE Finance Trust Management, L.P. is an affiliate of TPG Global, LLC (TPG), a leading global alternative investment firm, and the external advisor of TRTX and the collateral manager of the transaction.

TRTX reported a funded portfolio balance of $5 billion across 70 loans with an additional $662 million of future funding commitments, As of September 2019. All of the loans in the portfolio are floating rate and primarily secured by office (45%) and multifamily (24%) properties.

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY – FL2 as of November 2019.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds)/Total deal balance, N/A if not Managed or past reinvestment period.

Värde Partners

Värde Partners (Värde) is a global credit investment manager that focuses on investments in real estate and other alternative assets. Värde Partners has invested over $63 billion and has approximately $15 billion of assets under management as of September 30, 2019. Since 2007, Värde Partners has invested over $9 billion in performing, sub-performing and nonperforming U.S. commercial real estate credit as well as in residential credit assets, and Värde Partners has originated or acquired over $2 billion in CRE loans since in 2014.

Värde Partners (Värde) is a global credit investment manager that focuses on investments in real estate and other alternative assets. Värde Partners has invested over $63 billion and has approximately $15 billion of assets under management as of September 30, 2019. Since 2007, Värde Partners has invested over $9 billion in performing, sub-performing and nonperforming U.S. commercial real estate credit as well as in residential credit assets, and Värde Partners has originated or acquired over $2 billion in CRE loans since in 2014.

Trimont Real Estate Advisors, LLC, the servicer and special servicer of Värde Partner’s CRE CLOs, is a majority owned business by funds affiliated with Värde Partners. Trimont is primary servicer on 2,226 loans ($63.7 billion) and named special servicer on 39 securitizations ($16.2 billion), with 54 active specially serviced loans and REO ($156 million).

1 As of December 2019 pay date.

1 As of December 2019 pay date.

2 Based on total commitment at issuance = trust balance + future funding + pari passu outside the trust.

3 Most recent KLTV and KDY as of dates – FL1 as of March 2019, FL2 as of November 2019, and FL3 as of closing.

4 Pool Turnover % = (UPB of new assets since issuance + current cash – ramp-up proceeds) / Total deal balance, N/A if not Managed or past reinvestment period.