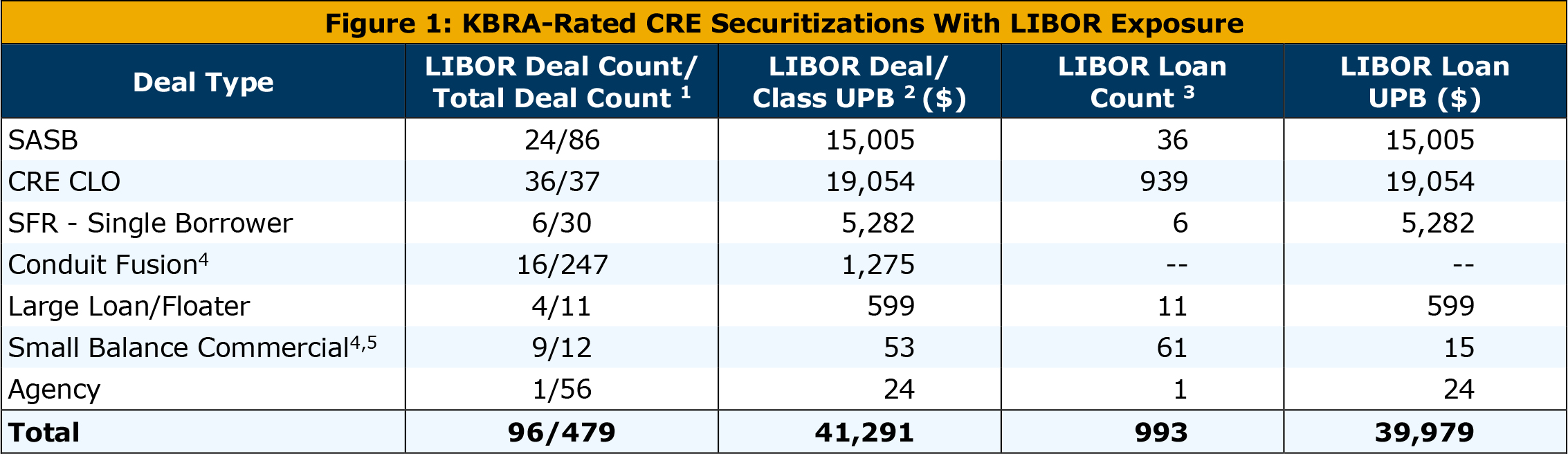

With the London Interbank Offered Rate (LIBOR) scheduled to expire at the close of 2021, KBRA continues to monitor our LIBOR-related exposure across multiple asset classes. We currently rate 96 commercial real estate (CRE) securitizations with bonds and/or loans indexed to LIBOR, with an aggregate unpaid balance of $41.3 billion. The deals are generally concentrated among floating rate single asset single borrower (SASB) transactions and CRE collateralized loan obligations (CLOs). However, there are a number of other exposure areas including single-family rental (SFR) securitizations, fixed/floating rate exchangeable certificates in conduits issued between 2013 and 2016, large loan (LL) transactions, small balance commercial, and Freddie Mac floating rate transactions (see Figure 1).

The Commercial Real Estate Finance Council (CREFC), an industry trade association, estimates that approximately $1.3 trillion of CRE debt is indexed to LIBOR.1 Of this amount, $200 billion is securitized, much of which includes Freddie Mac and Fannie Mae Agency CMBS (53%), private label SASB (33%), and CRE CLOs (10%).

Given the magnitude of LIBOR’s unavailability to the broader industry, this report seeks to provide some background surrounding the transition from LIBOR. KBRA’s operative assumption remains the same, namely, floating rate transactions are generally ratable and we do not expect to engage in widespread rating actions or Watch placements due to the cessation of LIBOR. That said, there are a number of hurdles related to the adoption of a replacement rate, including operational challenges, which could prompt rating actions on individual transactions. This paper outlines some of the issues that the market and existing KBRA-rated deals may face in the changeover, with a focus on SASB and CRE CLO transactions, which represent the bulk of KBRA’s rated CRE securitization exposure to LIBOR. We begin by highlighting aspects of the Secured Overnight Financing Rate (SOFR), the assumptive replacement benchmark, followed by a discussion of general and deal-specific risks.

1 Total deal count includes all fixed and floating rate transactions.

1 Total deal count includes all fixed and floating rate transactions.

2 Balances are as of December 2019.

3 The UPB (Unpaid Principal Balance) reflects only those classes which have LIBOR exposure.

4 Small Balance Commercial LIBOR based floating rate bonds are in three of the nine transactions with LIBOR based loans.

Sources: KBRA, Trepp

CRE Securitization: Transitioning Away From LIBOR

The Adoption of SOFR and ARRC Fallback Language

The industry continues to move toward determining a replacement rate and the processes needed to effectuate the change. In November 2014, the Federal Reserve Board of New York formed the Alternative Reference Rates Committee (ARRC) to identify a replacement rate for USD LIBOR. In June 2017, ARRC selected SOFR as the replacement rate and in March 2018 was tasked with developing strategies to facilitate the transition. CREFC and the Structured Finance Association (SFA) co-chaired the Securitization Working Group (SWG) to develop LIBOR transition language (so-called “fallback language”) to include in agreements governing LIBOR-based floating rate securitized products, in order to facilitate a smooth transition to SOFR. The industry began adopting SOFR-related replacement language in transactions in mid-2019. As such, it seems increasingly likely that SOFR will ultimately become the industry standard.

While in-depth details regarding SOFR and its history are beyond the scope of this report, it is helpful to understand some of the main issues associated with the transition, much of which is addressed by the ARRC fallback language.

The fallback language addresses the following issues:

- Triggers: What events should trigger the transition from LIBOR to a new replacement rate?

- Replacement Rate Fallback: What should be the new replacement rate? In addition, what should be the alternative rate if SOFR indices cease to exist by the time LIBOR becomes unavailable? We note that while ARRC has selected SOFR as its preferred rate, unresolved issues relating to the creation of term SOFR indices still remain. For example, SOFR is currently calculated as an overnight rate, while the most commonly used LIBOR is a one-month rate.

- Spread Adjustment: How should the rates be adjusted to account for the differences between LIBOR and the new rate? LIBOR has both a term and bank credit risk component, while SOFR is a risk-free overnight rate.

Federal Reserve Board’s Alternative Reference Rate Committee (ARRC)

- Frequently Asked Question, September 2019

- ARRC Recommendations Regarding More Robust Fallback Language for New Issuance of LIBOR Securitizations, May 2019

- LIBOR Update: Understanding the ARRC’s Securitization Fallback Language, November 2019.

- LIBOR Update: Why SOFR versus Treasuries, July 2019.

General Issues and Risks Before discussing deal-specific considerations, the issues highlighted below impact the market at a macro level or generally apply to all transactions:

Inconsistent Approach by Market Participants

A scenario in which market constituents adopt different measures to address the cessation of LIBOR could lead to borrowers having poor experiences, which could negatively impact future securitization volumes and potentially lead to litigation. Furthermore, uncertainty across deals could impact investor interest and reduce market liquidity. CREFC has been involved in developing solutions to mitigate such risks through its participation in the SWG and educational and advocacy efforts. In addition, coordinating a consistent industry approach will be easier given the limited number of servicers in the CRE securitization market, unlike sectors with a greater number of participants.

Litigation

Even if market participants adopt a consistent approach, language in the transaction documents varies greatly. If language is vague or contradictory, a borrower or investor may not agree with the interpretation presented by a servicer or certificate administrator. Managing those disputes may result in increased trust expenses.

Basis Mismatch

Deal-level documents may be inconsistent with the underlying loan-level documents. These inconsistencies are most prevalent in CRE CLOs, where the underlying loans in a deal may convert to various replacement rates, such as the prime rate or U.S. Treasuries, while the deal converts to SOFR.

Timing Mismatch

LIBOR-based loans generally have their rate determined at the beginning of an accrual period, while SOFR is an overnight rate. If a SOFR term rate or compound rate is not available at the time LIBOR is no longer available, there could be an issue with determining the loan payments as loan payment dates are generally prior to the end of the accrual period. At this time, most market participants are operating under the assumption that a term SOFR or compound SOFR will be available prior to the cessation of LIBOR.

Rate Cap Agreements

In general, there is no assurance that a rate cap agreement’s LIBOR replacement requirements, including timing, will match the related transaction’s replacement requirements. Additionally, an interest rate protection agreement with respect to the alternative rate for the transaction may not be available at a commercially reasonable cost. If the borrower does not or cannot enter into a substitute interest rate protection agreement, or an alternative option acceptable to the mortgage lender, the risks to certificate holders will be substantially the same as those that would arise if the applicable interest rate cap counterparty failed to pay under the original interest rate cap agreement.

Operational Risk

Servicers will need to perform a number of tasks to effectuate the transition, including making required system modifications to capture SOFR or an alternative rate, determining and managing appropriate spread adjustments, and calculating loan payments. Certificate administrators and calculation agents must also make such preparations for calculating floating rate bond payments. In addition, because the operative agreements may have varying language as it relates to the LIBOR cessation, the relevant parties will have to review the operative agreements to ascertain what are the specific requirements for determining the LIBOR replacement rate for the related loan or deal. The parties would also need to develop strategies to manage any differences, as well as how to communicate with individual borrowers and investors. Last year, KBRA began discussions with servicers on these efforts and will continue to monitor their progress as the transition approaches.

Investor Reporting

The CREFC Investor Reporting Package (IRP) will need to be amended in order to convey the new information, such as the replacement rates and spread adjustments both at the loan level and bond level. CREFC has started the process to gather feedback from market participants. Should changes be adopted to the IRP, market participants, such as servicers and information providers, will need to change their systems to produce and use the new reports.

Deal-Specific Issues and Mitigants In 2019, SASBs and CRE CLOs began to incorporate the ARRC fallback language at the deal level, explicitly identifying SOFR as the alternative rate. Prior to the publication of the ARRC fallback language, some deals provided for conversion to an unspecified rate that is a commonly accepted alternative to LIBOR. For example, the alternative rate may be described as a floating rate index that is commonly accepted by market participants in CMBS loans as an alternative to LIBOR and that is publicly recognized by the International Swaps and Derivatives Association (ISDA) as an alternative to LIBOR. KBRA anticipates that these deals will convert to SOFR. Other deals provide for the conversion to the prime rate or some other alternative rate.

KBRA-Rated SASB Deals A review of 24 KBRA-rated floating rate SASB deals for LIBOR-related transition language shows that the alternative rate provisions, at the deal level, fall into four main categories (see Figure 2).

A majority (18) of the 24 KBRA-rated SASB deals have alternative rate language that either explicitly specifies SOFR (explicit SOFR) or includes provisions that may result in conversion to SOFR upon its adoption by CMBS participants and its recognition by ISDA (soft SOFR). Deals without explicit SOFR language—even those with a clear replacement rate like prime—generally lack the fallbacks set out in the ARRC recommendations. Without any fallback language, many of the steps for participants to take during the transition are not spelled out, leaving more discretion for the servicer or certificate administrator and creating potential uncertainty.

Even the SASB transactions that have adopted the ARRC fallback language contain variations. For example, no KBRA-rated SASBs currently include the ARRC concept of an interpolated benchmark. The interpolated benchmark language addresses the issue of there being no matching term for the replacement rate (i.e., overnight SOFR) compared to the term of the then current rate (i.e., one-month LIBOR). Instead, the relevant party in the securitization will choose either an adjusted term SOFR or an adjusted compounded SOFR, and may also look to the ISDA fallback rate. Finally, some SASB transactions include an early opt-in election (i.e., prior to LIBOR unavailability, a conversion to SOFR based on a determination that SOFR has been adopted in similar CMBS loans), a concept that is not in the ARRC fallback provisions.

Issues and Mitigating Factors in SASBs:

- The SASB market is dominated by several large borrowers. Blackstone and Brookfield are sponsors of the borrowers in 13 of the 24 KBRA-rated SASB deals. Also, there are only two servicers across the KBRA-rated SASB transactions. Given the limited number of servicers and borrowers in this sector and the importance of these borrowers to this market, the parties are incentivized to work together to effectuate a smooth transition.

- If the borrowers are not satisfied with the transition from LIBOR in their transactions, most SASB deals have a maturity date or extension date that would allow the deal to be paid off and refinanced before the end of 2021, when LIBOR is expected to cease, or no more than a year thereafter.

- As most SASBs involve only one loan and one borrower, coordinating the transition at the deal and loan level is relatively simple. Most deals require the certificate administrator and the servicer to coordinate the deal-level and loan-level conversions. In the event of a discrepancy, the servicer’s determination will prevail.

- If there is a timing mismatch on the calculations for the rate cap agreement versus the loan payment, it is likely to be fairly de minimis.

We reviewed the 36 KBRA-rated CRE CLO deals for related LIBOR transition language. At the deal level, the alternative rate provisions fall into the following categories:

Issues and Mitigating Factors in CRE CLOs:

- Multiple underlying loans with various alternative rate provisions create a greater likelihood for basis mismatch between the notes and the underlying loans. In a given deal, some loans may switch to SOFR while others switch to the prime rate. In some transactions, if at least 50% of the loans convert to an alternative or substitute index, then a benchmark transition event will be deemed to have occurred and the notes will convert to the alternative index. The deals are generally structured so that all excess interest flows to an equity class that is usually retained by the issuer. It is expected that the equity class would absorb shortfalls resulting from a mismatch in rates, making it less likely to negatively impact the rated classes. Also, in the unlikely scenario that a shortfall would impact the subordinate classes, interest payments to such classes may be deferred but paid prior to any principal or interest distribution to the equity class.

- Where the operative documents do not provide for an alternative rate (i.e., where the definition of LIBOR requires the party determining the LIBOR rate to obtain several quotes from reference banks in the event that LIBOR is not available), it may be difficult for the party responsible for making the LIBOR rate determination to obtain such quotes.

- All the deals rated by KBRA to date have optional redemption periods that start prior to the end of 2021. This allows the issuer to potentially call the deal if issues arise with the LIBOR transition.

- Collateral managers generally have a closer relationship with borrowers compared to typical fixed rate conduit originators. Due to the transitional nature of the property, it is very likely that the collateral manager or servicer is already actively engaged with the borrower. This relationship could facilitate the transition from LIBOR.

- Where the underlying loans in a deal are originated by a single lender, there may be more uniformity in the loan provisions than in a multi-originator pool. This may help mitigate operational challenges of the transition from LIBOR.

Single-Family Rental (SFR)

All of the KBRA-rated Invitation Home (IH) transactions are floating rate loans. No other single-borrower or multi-borrower SFR transaction rated by KBRA has floating rate bonds or floating rate loans. The IH deals are essentially like other SASB deals and would generally be categorized as having soft SOFR language. All the IH transactions have their next maturity dates prior to the end of 2021 and generally have two to five 12-month extensions available.

Floating Rate Classes in Fixed Rate Conduits

There are a number of fixed rate conduits that contain floating rate classes based on an interest rate swap agreement. KBRA has identified 16 classes in 16 deals we rated between 2013 and 2016 with an aggregate class balance of $1.3 billion. The floating rate classes (FL) are exchangeable with a fixed rate class (FX) that equals the balance of a designated regular interest certificate. If LIBOR is no longer available, the transactions generally default to the last determined LIBOR rate or require the certificate administrator to determine the rate based on quotes from various London or major U.S. banks. If the related interest rate swap agreement defaults or is unavailable, the class would default to the fixed rate. In these instances, KBRA generally rates to the fixed rate of interest.

Large Loan Floaters

KBRA has identified four 2014 vintage large loan floaters in its rated CRE portfolio. One has two loans remaining and the other three each have one loan remaining. Each loan has passed its original fully extended maturity date. Of the five loans, per the servicer reporting, three have been modified and extended as of December 2019 (see remaining loans in Appendix III). Based on a review of the offering documents, if LIBOR is no longer available, all the remaining loans and certificates convert to a prime rate with an applicable spread.

Small Balance Commercial (SBC)

Of the SBC deals rated by KBRA, the Velocity Commercial Capital (VCC) transactions have some LIBOR exposure. As of December 2019, nine of the 11 VCC deals rated by KBRA have a small percentage of LIBOR-based floating rate loans, ranging from less than 0.1% to as much as 7% of pool balance (see Appendix III). The transactions are structured with an excess interest class along with unrated subordinate classes that would absorb any shortfalls due to a mismatch between the interest generated by the loans and the certificates. In addition, three of the securitizations issued in 2016 and 2017 have a LIBOR-based floating rate class outstanding that pays at the lower of LIBOR or WAC. In two of the transactions, the language defaults to the last determined LIBOR rate, while the remaining deal contains language that allows for an alternative index.

Freddie Mac

KBRA rated just one Freddie Mac (FM) floating rate transaction, FREMF 2013-KF02. Freddie Mac K-Series floating rate transactions are generally not rated. FREMF 2013-KF02 has only one loan remaining that is scheduled to mature on June 2020. In the case LIBOR is no longer available, the operative documents direct the calculation agent to designate an alternative index. Freddie Mac is expected to publish LIBOR transition guidance in 2020.

Appendix I: KBRA-Rated SASB Deals

1 Deal Balance as of December 2019.

1 Deal Balance as of December 2019.

Sources: KBRA, Trepp

Appendix II: KBRA-Rated CRE CLOs

1 Deal balance as of December 2019.

1 Deal balance as of December 2019.

Sources: KBRA, Trepp

Appendix III: Other KBRA-Rated Deals With LIBOR Exposure

1 Deal balance as of December 2019.

1 Deal balance as of December 2019.

2 Following a merger between Invitation Homes and Starwood Waypoint Homes (SWH) on November 16, 2017, SWH manages the homes in the subject transactions.

Sources: KBRA, Trepp

1 Deal balance as of December 2019.

1 Deal balance as of December 2019.

2 FL Class Balance is the maximum current balance.

3 Other - converts to the mean of the rates quoted by major banks in New York.

Sources: KBRA, Trepp

1 Deal balance as of December 2019.

1 Deal balance as of December 2019.

Sources: KBRA, Trepp

1 Balances as of December 2019.

1 Balances as of December 2019.

2 NAP means Not Applicable as not all deals have a floating rate class.

3 Loan-Level exposure as of December 2019.

Sources: KBRA, Trepp

1 Deal Balances as of December 2019.

1 Deal Balances as of December 2019.

Sources: KBRA, Trepp